Doubling down on resilience in an uncertain world 6th February 2026

Ten years ago the Swiss dismantled the remains of Cold War explosives previously embedded in its roads,...

Resilience strategies are critical to sustaining long-term success 6th February 2026

New Airmic-BCI report reveals that organisational resilience is at a pivotal moment of development. Amid a...

Global Risks Report 2026: An urgent call for boardroom action on property, infrastructure and operational resilience 6th February 2026

Zurich’s Penny Seach analyses the World Economic Forum’s latest risk report, and provides practical next...

From seabed security to space satellites: how Orange manages risk and resilience in turbulent times 6th February 2026

Airmic News spoke to James Ingham, group risk manager at Orange, about the key risks in telecoms, why their...

Together Stronger: FERMA’s next chapter 6th February 2026

Airmic had an exclusive joint interview with FERMA’s new leadership, President Philippe Cotelle and CEO...

PRA steps up a gear on UK Captive regime and tells Airmic members: “we are listening” 6th February 2026

Airmic News had an exclusive interview with Shoib Khan, director of insurance at the PRA. Alongside his...

Edelman Trust Barometer: Major survey shows trust in decline and insularity on the rise 6th February 2026

Findings have significant implications for risk professionals, AXA’s Matthew Reeves, a speaker at Airmic’s...

Most of today’s top business risks are uninsurable: Aon 6th February 2026

Risk management must evolve into a strategic, data-driven and collaborative profession in response to the...

Airmic welcomes HDI as Senior Partners 6th February 2026

Airmic is delighted to announce that HDI Global, insurance provider and complex risk specialist, has become...

Airmic launches Sustainability Steering Group 6th February 2026

Airmic has formed a steering group tasked with developing a sustainability strategy for the Association.

We must learn from our past – but position ourselves for the future 17th December 2025

At this time of year many organisations reflect on their achievements over the last twelve months. By...

Innovation, ambition and strategy: Ireland puts insurance sector at heart of its vision 17th December 2025

Ireland is emerging as a global centre for insurance innovation and long-term growth, its Minister of State...

From agility to survival: lessons in risk from Ireland’s SMEs 17th December 2025

Despite their distinct risk management needs and capabilities, SMEs and large enterprises can learn from...

Lithium-ion batteries: five key steps for risk professionals 17th December 2025

Lucy Pinkard, associate forensic investigator, lecturer and industry executive at Hawkins, demystified the...

Parametric solutions go mainstream as data improvements drive demand 17th December 2025

UK corporates face an increasingly complex risk landscape. Weather extremes, supply chain fragility,...

Airmic Excellence Awards – winners announced! 17th December 2025

Eight outstanding individuals and teams were celebrated at the Airmic Excellence Awards in Park Lane this...

“We lift young people’s horizons through inspiration” 17th December 2025

Airmic Dinner guests show generous support for Renaissance Foundation

Airmic CEO: Start preparing now for UK captive regime 17th December 2025

2025 has been a landmark year for captives with the UK announcing highly anticipated plans to become a...

Airmic Talks: Island of Ireland 2025 17th December 2025

This episode of Airmic Talks was recorded in Dublin where we recently held the Airmic Island of Ireland...

Richard James on managing nuclear risks: “There’s no room for error” 17th December 2025

Richard James, head of risk at Nuclear Transport Solutions and deputy chair of Airmic’s Risk Management...

New generation risks demand new generation risk professionals 14th November 2025

In this edition of Airmic News, an article by Jim Wetekamp, CEO of Airmic Partner Riskonnect, discusses the...

Take risks and be passionate: how to become a successful leader 14th November 2025

Experienced risk and insurance leaders gave attendees at Airmic’s fastTrack Forum valuable advice on how to...

Career reflections with Lisa Meredith: “You need to be creative, persuasive and engaging” 14th November 2025

After working her way from a seasonal store role in M&S to part of the insurance team, Lisa Meredith is...

Risk professionals increasing strategic influence amid global volatility 14th November 2025

For risk professionals, the shift from operational to strategic roles is a key stage of career progression....

How AI is reshaping risk management: the opportunities, risks and where to use it 14th November 2025

AI is changing so fast, it’s hard to know when it should be used, where to use it and how to make sure it...

Building risk maturity through education 14th November 2025

Airmic’s Risk Management Fundamentals course aims to equip all professionals with the knowledge to think...

The transformative impact of career mentors 14th November 2025

Achieving career success lies not only in on-the-job talent, but in having judgement, developing networks...

Applications are open for the 2026 Airmic Business Excellence Programme! 14th November 2025

Are you ready to take your career to the next level?

Airmic welcomes new board members 14th November 2025

Airmic members Alison Tamm and Ivor O’Hehir have joined the Airmic board with immediate effect.

Airmic student member Nitesh Dokhe begins IHG internship 14th November 2025

Dokhe was selected as part of Airmic’s collaboration internship programme.

HSF Kramer becomes Senior Partner 14th November 2025

Airmic is delighted that Herbert Smith Freehills Kramer has upgraded its partnership, becoming the first...

Renaissance Foundation named as Airmic charity 14th November 2025

Airmic is proud to announce a long-term partnership with a London-based charity that supports young people...

Lloyd’s unveils memorial honouring victims of slavery 14th November 2025

Lloyd’s of London has unveiled a new memorial at its City headquarters this month to commemorate the...

Is uncertainty the new opportunity? 14th October 2025

Levels of uncertainty have never been higher. The latest World Uncertainty Index – a measure of global...

The UK must learn to take risk again, Lord Mayor of London tells Airmic AGM 14th October 2025

The UK’s financial services sector must regain its appetite for taking responsible risk if it is to grow,...

Airmic gives voice to Next Gen risk professionals with Shadow Board appointments 14th October 2025

Initiative will inject fresh perspectives and new ideas

Empower the Next Gen: sign up now for the Autumn fastTrack Forum 14th October 2025

Airmic’s annual fastTrack Forum takes place on 15 October, hosted by WTW. Tailored for Airmic members who...

Airmic’s Risk Management Fundamentals course receives CPD accreditation 14th October 2025

Airmic is excited to announce that its Risk Management Fundamentals (RMF) course has officially received...

Turning emerging risks into strategic advantage 14th October 2025

Nebulous, under-researched and constantly changing: managing emerging risks is both an art and a science....

Emerging risks: What is the real threat from PFAS? 14th October 2025

Christian Crozier, head of corporate casualty, UK, Sompo considers the future risk implications of so...

Emerging risks: Artificial intelligence: will your insurance payout? 14th October 2025

Lydia Savill, partner, and Matt Steven, associate, at Hogan Lovells provides practical insights for risk...

AI: new Law Commission paper shines light on emerging legal complications 14th October 2025

The Law Commission has published a discussion paper examining the emerging legal challenges posed by the...

Emerging risks: climate risk to supply chains: have you mapped your exposures? 14th October 2025

Dr Iain Willis, director at climate risk modelling firm TransZero, demonstrates how worsening extreme...

Guernsey panel debate: captives go mainstream 14th October 2025

Once seen as niche tools for navigating hard insurance markets, captives have now cemented themselves as a...

RSA rebrands to Intact Insurance 14th October 2025

Airmic partner RSA formally rebranded to Intact Insurance as of 6 October

Building the bridge to the future: join us in Dublin for Airmic’s Island of Ireland Conference 2025 14th October 2025

On 19 November 2025, the Airmic community will gather in Dublin for the annual Island of Ireland Conference...

Airmic Members taking a Lead on captives 6th August 2025

It will come as no surprise to our readers that the announcement last month that HM Treasury will proceed...

Captive momentum builds as Airmic welcomes government’s UK domicile decision 6th August 2025

Members to contribute to policy design through government’s Sector Expert Groups.

Analysis: What will a world-class UK captive regime look like? 6th August 2025

With the UK getting the government go-ahead to establish a captive domicile, the real work is only just...

Leading the way in risk financing: Airmic Guernsey Conference 2025 6th August 2025

Registrations open!

From alternative to essential: how captives are enhancing business resilience in a riskier world 6th August 2025

Captives are steadily evolving from specialist tools into strategic enablers of resilience.

Swiss Re: Global fragmentation is widening protection gaps 6th August 2025

Latest Sigma research warns of slowing global growth and reduced international cooperation.

Leadership strategies for navigating regulatory and legal risks 6th August 2025

Book now for September: Leadership Masterclass series.

Out of this world: the future of space insurance 6th August 2025

Book now for September: Airmic Academy workshop.

“We’ve shown that insurance is capable of long-term meaningful change” 6th August 2025

Q&A with Chris Wallace, founder of Insurance United Against Dementia.

The risk of missed opportunities 27th June 2025

First, a big thank you to those who joined our annual conference this year. It was incredible to welcome...

What’s permanent and what’s temporary? Intact CEO on navigating geopolitical turmoil 27th June 2025

Tail risk is up globally and businesses should be prepared for a wide range of scenarios, the conference...

The relevance of innovation in a dynamic world: how should businesses respond? 27th June 2025

With AI developing at pace, both for businesses and cyber attackers, how can we build trust into the system...

Robert Peston: “Could the world turn its back on America?” 27th June 2025

“We are living through history”, political commentator and broadcast journalist, Robert Peston, told Airmic...

Europe’s wakeup call: what does geopolitical uncertainty mean for the UK and its neighbours? 27th June 2025

With global political tectonic plates shifting, and the U.S. no longer considered a reliable ally, can...

Risk technology is making our lives safer – but better education is vital 27th June 2025

Artificial intelligence is transforming the way insurers and brokers manage and assess risk and is driving...

Global climate consensus is facing geopolitical headwinds 27th June 2025

The global transition to a low carbon economy is being challenged by geopolitical headwinds, according to a...

Businesses must learn to live with uncertainty: Charles Hecker 27th June 2025

“We’ve had a complete inversion of where risk lives...It used to reside in the future, now it exists in the...

Government captive decision will be “huge win” for the UK 4th July 2025

It would be a “huge win” for the UK to become a captive domicile, cementing it as the world leader for...

2025 Member Survey: risk profession is proving its strategic value 27th June 2025

Results reveal the top risks and opportunities reported by members, as well as key trends in roles,...

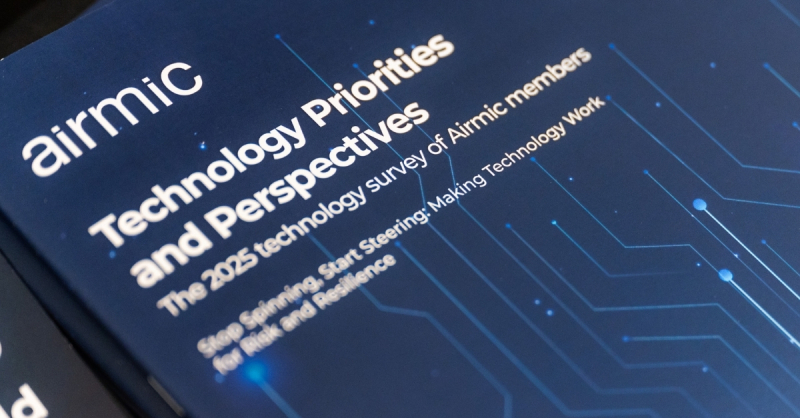

Tech survey shows risk profession at AI inflection point 27th June 2025

Gen AI uptake remains low but growing appetite for technological advancement

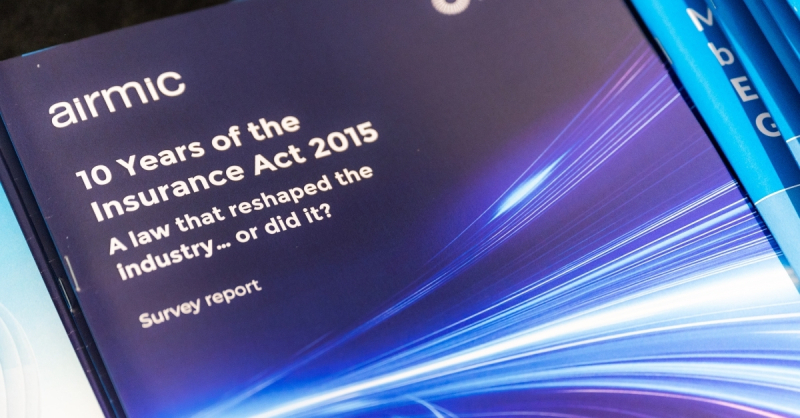

Insurance Act has had “positive” impact on placement, say Airmic members 27th June 2025

However, survey suggests use of conditions precedent is rising.

Airmic News is back! 5th June 2025

With a new format and a new editor – we welcome Jessica Titherington who re-joins Airmic following her...

100 days of Trump: how risk managers are adapting to a state of “perma-crisis” 5th June 2025

Airmic members are reporting challenges around supply chains, regulation and managing high uncertainty, say...

Retail cyber attacks: boards must engage more with cyber security, government urges UK businesses 5th June 2025

Writing for Airmic News, cyber security minister, Feryal Clark, says that the new Cyber Governance Code...

Iberian power cuts exposed a lack of business resilience in a digital world 5th June 2025

Many UK companies are underprepared for a similar event, say Marsh experts. Here, they outline seven...

Another World Is Possible: what to expect at Liverpool 2025 5th June 2025

The countdown to Airmic’s annual conference has begun!

AI can get risk managers “to a higher level” says risk tech expert 5th June 2025

Airmic to publish first-of-a-kind report into the use of technology among UK risk managers.

Lord Mayor of London confirmed as guest speaker at AGM 5th June 2025

Meeting will take place in Central London in September.

CNA Hardy becomes an Airmic Senior Partner 5th June 2025

Partnership is a “significant benefit” for Airmic members.

Continue your Professional Journey this June 5th June 2025

Register today for Airmic’s Student, fastTrack and Leadership Masterclass learning opportunities.

Airmic’s Risk Management Fundamentals course coming to Manchester 5th June 2025

Ideal for newcomers to risk management and non-risk professionals seeking an understanding of risk.

Airmic expands marketing team with two new hires 5th June 2025

Former journalists Francesca Capitelli and Jessica Titherington join as Airmic grows its digital capability.

Trick or Treat? 1st November 2024

The UK Budget on 30 October made history. It was the first budget to be delivered by a woman, and the first...

Donations for the Airmic Annual Charity are off to a flying start! 1st November 2024

Thanks to the incredible efforts of all the volunteers and corporate partners who took part in the London...

Airmic are delighted to announce that the annual Business Excellence Programme will once again run in 2025. 29th October 2024

Sponsored by AXA XL and supervised by Glasgow Caledonian University, this programme, exclusive to, and free...

CrowdStrike event could push more cyber risk into captives 29th October 2024

Uncertainly over where losses will fall with expected disputes over wordings

CrowdStrike making captives r...

Captives can be key to managing climate risk 29th October 2024

Risk management is evolving to address climate change and sustainability challenges, with captives playing...

Tech-tonic shifts – How AI could change industry risk landscapes 29th October 2024

The potential benefits of artificial intelligence (AI) are immense. Swiss Re has written extensively on how...

Key risks are becoming insurable: FERMA survey of risk managers 31st October 2024

Fifty-three percent of risk managers think some of their organisation’s activities or locations will become...

Preparing for the Economic Crime & Corporate Transparency Act 31st October 2024

The Economic Crime & Corporate Transparency Act (ECCTA), the first significant provisions of which came...

Ready to Shape the Future of Risk Management and Insurance? 31st October 2024

The FastTrack Forum is here to give you front-row access to the latest in emerging risks, digital...

Fiona Davidge elected as Chair of Airmic 20th September 2024

Fiona Davidge was elected as Chair of Airmic at the Airmic Annual General Meeting on 10 September. Fiona...

Stakeholder of AI code should be the business as a whole, Airmic says 3rd September 2024

Airmic has called for the UK government’s proposed Code of Practice on AI cyber security to consider the...

Tackling Cargo Crime in 2024 Cargo crime on UK roads has risen during the cost of living crisis. 4th September 2024

With cargo theft hitting record highs in 2023, it's crucial for brokers and customers to stay ahead of the...

Adopting a proactive approach to regulatory change 12th September 2024

In today's fast-changing business environment, the C-suite must adjust daily to numerous challenges that...

Urgent need to understand challenges faced in energy transition, Airmic says 4th September 2024

There is an urgent need to understand the challenges faced by risk professionals and their organisations as...

Insuring the truth: protecting your business against misinformation 9th September 2024

The world of insurance is at the forefront of the threats posed by the spread of misinformation and...

Momentum remains behind UK captive efforts 1st August 2024

While Labour’s election victory on 4 July is expected to delay progress on the proposed United Kingdom...

CrowdStrike IT outage: Guidance for Airmic members on the CrowdStrike outage and insurance implications – Priority actions 26th July 2024

This note is intended to assist Airmic members in considering the insurance implications of the CrowdStrike...

Urgent Alert: Rising Threat of Hybrid Warfare in 2024 25th July 2024

KCS Groups monitoring reveals a significant uptick in hybrid warfare activities, primarily driven by...

Risk Management Fundamentals (RMF) Course 2nd August 2024

We are excited to announce that after a highly successful pilot, the Airmic Risk Management Fundamentals ...

Endorsed Learning Providers - New from Airmic 28th February 2024

To gain the Airmic Endorsement Mark, carefully selected third party learning providers offering their own...

Allianz Safety and Shipping Review 2024 25th July 2024

Shipping losses hit an all-time low despite increasing risks for the whole sector:

Insurance Without Borders: Mitigating Global Instability with Global Delivery 25th July 2024

Every international business faces a delicate balancing act – maintaining a uniform, consistent standard of...

Past Case, Present Lessons: Essential Insights for NEDs 25th July 2024

Past Case, Present Lessons: Essential Insights for NEDs

Good practice guidance on directors’ duties.

GIIA, Airmic host first Guernsey Captive Conference 31st July 2024

The first GIIA and Airmic Conference was heralded a “great success” with a capacity audience of over 200...

Who will foot the bill for Pre- investigation interviews with the serious fraud office? 25th July 2024

The Personal Liability Implications for Directors of the SFO’s New Investigatory Powers

UK business leaders reporting rising concerns on risk of litigation regarding ESG targets 29th February 2024

Gallagher research reveals ESG litigation is now considered a significant and growing risk to businesses...

Long-awaited Audit reform makes it into King’s Speech 1st August 2024

New regulator to replace the Financial Reporting Council (FRC)...

Airmic in Edinburgh 1st July 2024

Great things happened when we worked together to consider Tomorrow’s Risks Today.

The optimist: Airmic’s chair urges the industry to confidently sell itself as a destination career 20th June 2024

Six months into her tenure as Airmic chair, Angela Iannetta reflects on how the risk profession has evolved...

Unlocking Tomorrow’s Careers Today: Highlights from This Year’s Airmic Annual Conference Student Programme 20th June 2024

The Student Programme at this year’s Airmic conference was a great success, with over 30 attending from...

The Big Question… 12th April 2024

Airmic has been saying that the real-time monitoring of risks is important.

See you In Edinburgh! 10th April 2024

Our world is turbulent, suffering from geopolitical, economic and climate tensions, with risks and...

Monday is a full day – and all delegates are welcome! 16th April 2024

In 2024, the first day of the conference will be open to all with a packed programme of ‘101’ learning...

Airmic is back in Dublin! The Island of Ireland Conference – Dublin – 3 October 2024 15th April 2024

This popular event will once again take place at the Intercontinental Hotel with a day packed full with...

RSA Sponsors Airmic Mentoring Program 11th April 2024

We are delighted to announce that RSA has kindly agreed to join us as sponsor of the Airmic Mentoring...

Leadership Masterclass Series 2024 10th April 2024

We’re delighted to announce the launch of this year’s hugely popular Leadership Masterclass Series.

Airmic Live: Cyber attacks and the tide of misinformation 12th April 2024

Airmic Live – the webinar series dedicated to keeping Airmic members primed on the key trends and...

New Senior and Associate Partners ahead of Edinburgh 2024 Conference 11th April 2024

Airmic’s partnership space continues to thrive with the addition of a new Senior Partner and two new...

4 things to consider when choosing an international insurer 11th April 2024

With the ever-evolving global landscape from post-pandemic consequences to the cost-of-living crisis, war...

Many UK businesses are unprepared to meet incoming anti-terrorism laws 11th April 2024

New terrorism preparedness legislation is expected to become UK law later this year, but many businesses...

The 2024 Airmic Captives Forum – 6 March at Lloyd’s 12th April 2024

What a day!

The programme at the third Airmic Captives Forum did not disappoint. With a capacity attendance...

Russia’s war in Ukraine turns two: insuring risk now, not afterwards 28th February 2024

As Russia’s war in Ukraine enters its third year, how is the insurance market working to sustain Ukraine’s...

Airmic Captives Long Read: Importance of iNEDs rising as captives become more complex 28th February 2024

As the popularity, complexity and sophistication of captives continues to increase, the importance of...

Exploring the risks of AI across the accounting Profession 28th February 2024

The recent declaration issued by countries attending the AI Safety Summit hosted by the UK Government at...

Endorsed Learning Providers - New from Airmic 28th February 2024

To gain the Airmic Endorsement Mark, carefully selected third party learning providers offering their own...

Rethinking transportation and logistics supply chains 28th February 2024

The transport and logistics industry has a market value of $9.7trn and underpins $89trn of global trade....

Become a member of Airmic and join a community of professionals who are driving the transformation and change of our profession. 28th February 2024

As an Airmic member, you will find answers to support your professional development through accessing the...

Towards real-time risk monitoring: Airmic launches the Big Question 28th February 2024

Airmic launched the Big Question on 5 February, marking a new and innovative way in which Airmic will be...

Red Sea shipping attacks: supply chains under strain 28th February 2024

Since November, dozens of merchant ships have been targeted in the Red Sea. Attacks on shipping are...

Gibraltar seeking new captive position: from: Airmic Correspondent Richard Cutcher 28th February 2024

Nigel Feetham MP, Gibraltar’s new Minister for Justice, Trade and Industry, has invited local stakeholders...

M&A trends in the UK insurance sector 28th February 2024

The signs at the start of 2024 point to it being a busy year for M&A activity, though it may be the...

Russia’s war in Ukraine turns two: insuring risk now, not afterwards 28th February 2024

As Russia’s war in Ukraine enters its third year, how is the insurance market working to sustain Ukraine’s...

The Economic Crime and Corporate Transparency Act 2023: A Questionable Late Christmas Present for Companies and Senior Managers 28th February 2024

On 26th December 2023, the attribution rules relating to corporate criminal responsibility for economic...

UK business leaders reporting rising concerns on risk of litigation regarding ESG targets 29th February 2024

Gallagher research reveals ESG litigation is now considered a significant and growing risk to businesses...

Just released - The Twelve Months of Airmic 16th January 2024

Just released - The Twelve Months of Airmic

Risk Leadership – Managing AI’s risks and opportunities 13th December 2023

The Risk Forum hosted a ‘fireside conversation’ which considered what organisations should be doing now to...

Checkmate or stalemate: The global standoff between world leaders and citizens – KCS Europe 13th December 2023

From the beginning of 2023, the geopolitical landscape has been marked by a series of escalating tensions...

Promoting Talent, boosting resilience and growing the pool 14th December 2023

The theme of this issue of Airmic News echoes that of the recent Risk Forum and Exhibition hosted by Airmic...

Marsh McLennan launches ‘Unity’ collaboration to insure Ukrainian Black Sea exports 13th December 2023

Broking group Marsh McLennan has announced that it is working with a number of parties, including banks,...

Delay announced to Blueprint Two at Lloyd’s 13th December 2023

Phase two of the Lloyd’s market’s digital transformation plan has been put back from October 2024 to April...

Resilient cities study rates New York top and London third 13th December 2023

City level planning is driving resilience, according to a study by The Economist in association with...

EU told new director regulations would create 'confusion and complexity' 13th December 2023

The European Union has been urged to drop plans to create a fresh batch of regulations on directors'...

All the winners from the Airmic Excellence Awards 2023 13th December 2023

The Airmic 2023 Excellence Awards took place at our Annual Dinner, with the event hosted by Airmic’s chair...

Disaster insurance reimagined – an interview with co-author Paula Jarzabkowski 13th December 2023

A new open-access book, downloadable for free, focuses on the evolution of public-private disaster...

Court of Appeal confirms courts can compel parties to engage in ADR – Clyde & Co briefing 13th December 2023

The decision on alternative dispute resolution (ADR) is anticipated to have widespread impact and departed...

Nick Hughes awarded Honorary Vice President of Airmic 13th December 2023

Nick Hughes collected a certificate for the rare honour at the Airmic Annual Dinner 2023.

Airmic welcomes UK Government plans to introduce a captive insurance regime, 2024 consultation 13th December 2023

The UK government has signalled its intentions to introduce a national regime for captive insurance...

Rebuilding culture and regaining trust 31st October 2023

The CBI’s chief people officer and Principia Advisory’s CEO are to address the Airmic Risk Forum on 23...

Control Risks: Israel-Hamas conflict to heighten cyber espionage and disruptive cyber threats 31st October 2023

On 7 October 2023, the Palestinian militant group Hamas launched a surprise, multi-pronged terrorist attack...

KCS Europe: Saudi Arabia travel advice 31st October 2023

Intelligence briefing provided by Stuart Poole-Robb, James Poole-Robb and Lucas Lyons of KCS Group Europe.

Escalation risks mount beyond Gaza for Israel’s conflict with Hamas 31st October 2023

The risk of regional conflict in the Middle East was addressed by Elizabeth Stephens, managing director,...

Ukrainian grain and its relationship to African food security and political stability 31st October 2023

Crispin Hodges, head of trade political risk, Canopius, discussed the consequences for political...

Silent Partners – organised crime’s black market activities 31st October 2023

A troubling and complex issue has emerged in response to the US-led sanctions on Russia following its...

Government to delay audit reform plans 31st October 2023

The UK government will be omitting its overhaul of the UK’s audit and corporate governance regimes from...

Spotlight on Business Travel–The inside view from risk managers – business travel risk and ISO 31030 6th November 2023

To get a clear picture of how the ISO standard is being used to support business travel risk management,...

Aon finds that cyber risk is an increasingly relevant topic for pension schemes 31st October 2023

A pensions sector risk survey from Aon highlights little common ground for trustees and sponsors....

Allen & Overy and Shearman & Sterling finalise merger agreement 31st October 2023

A merger between two corporate law firms will create third-largest legal firm in the world by total...

Broader pipeline required for captive iNED positions 31st October 2023

The Guernsey captive market is working hard to develop a broader pool of suitable candidates for...

HSF: The winds of change – What next for public law climate disputes in the UK? 31st October 2023

Initially reluctant courts may play a bigger role in protecting green targets in future as high-profile...

Martyn’s Law still in need of fine-tuning, says law firm 31st October 2023

Financial and administrative burden on smaller events and organisations may be too high.

New FRC research highlights ongoing gender imbalance in actuarial profession 1st November 2023

The Financial Reporting Council (FRC) has published new research examining gender imbalance amongst...

This week we are reading : Disaster Insurance Reimagined : Protection in a Time of Increasing Risk. 6th November 2023

As natural disasters increase in frequency around the globe leaving countries struggling to respond to the...

Cyber market still has ground to make up, says Gallagher Re 31st October 2023

The reinsurance broker says that the cyber insurance market is developing rapidly, but blind spots exist,...

Lloyd’s models potential $3.5trn exposure from major cyber attack 31st October 2023

The London insurance market has undertaken a scenario analysis of a major cyber catastrophe event that...

Island of Ireland Forum: risk profession facing a fraught decade, says Airmic CEO 31st October 2023

Julia Graham, CEO of Airmic, delivered a speech to welcome attendees to the second Island of Ireland Forum,...

Island of Ireland Forum: Personal injury in Ireland – a rapidly changing landscape 31st October 2023

Following 20 years of stagnation, the personal injuries landscape in Ireland has over the last two years...

Captives work best in collaboration with commercial market 31st October 2023

Captive insurance companies are most effective for the parent group when operated alongside the commercial...

Airmic Sustainability SIG 1st November 2023

Impassioned debate thrived at the latest meeting of the Airmic Sustainability SIG, as participants debated...

Call for new Airmic Board Members 24th October 2023

Interested in making a difference and contributing to the strategic direction of your association? ...

The Future is Now. The Future is AI 4th October 2023

In this exclusive interview with Dr. Daniel Hulme, we delve into the forefront of AI technologies and their...

Airmic welcomes new chair Angela Iannetta 21st September 2023

Airmic welcomes new chair Angela Iannetta

Ireland’s Finance Minister to open 2023 Island of Ireland Forum – open for registration 4th October 2023

Jennifer Carroll MacNeill, Minister of State at the Department of Finance, Government of Ireland, with...

China’s Post-Pandemic Euphoria Didn’t Last – Moody’s Analytics 21st September 2023

Katrina Ell, director of economic research, Moody’s Analytics and Harry Murphy Cruise, economist and...

Ukraine war risk and geopolitics at the top of IUMI’s agenda 21st September 2023

President of IUMI Frédéric Denèfle focused on geopolitical risk events in comments to the media and in his...

Airmic weighs in on proposed revisions to UK Corporate Governance Code 21st September 2023

A roundtable co-hosted by Airmic on 5 September on proposed revisions to the UK Corporate Governance Code...

Airmic’s new Construction SIG: What’s on the agenda? 21st September 2023

The latest of Airmic’s Special Interest Groups (SIGs), the Construction SIG is set to meet on 11 October,...

The Future of Food - Balancing Risk and Opportunity 21st September 2023

Agriculture makes up a substantial percentage of the world’s greenhouse gas emissions, prompting farmers,...

Play-by-play techniques for the agile risk professional currently fielding a spreadsheet-based roster 4th October 2023

When deciding on whether to invest in a RMIS or to keep grinding risk and insurance information in Excel,...

IUMI president characterises marine insurance role as “strength and stability in turbulent seas” 21st September 2023

Opening the International Union of Marine Insurance (IUMI) annual conference in Edinburgh, IUMI’s president...

IUMI: sanctions and a “dark fleet” circumventing them loom large as marine risks 4th October 2023

Sanctions on Russia are evolving fast and here for the long-term, IUMI speakers noted, while the dark fleet...

Electric vehicles’ fire risk and transportation safety under IUMI’s spotlight 21st September 2023

Recent alarm about fire risks for EVs, particularly when transported in large numbers as cargo, was a focus...

Swiss Re chief economist delivers upbeat forecast 21st September 2023

Jérôme Haegeli spoke to Airmic News editor David Benyon at the recent reinsurance rendezvous about...

Regulator puts onus on Government to oversee Brexit dividend of £100bn insurance investment 21st September 2023

The head of the PRA answered MPs’ questions at a meeting of the Treasury Sub-Committee on Financial...

City Minister hosts captive roundtable at the Treasury 4th October 2023

Experts from across the global risk transfer value chain joined City Minister Andrew Griffith to consider...

Celebrating the Success of Our First Belfast SIG! 4th October 2023

The success of our first Belfast Business Networking Group meeting (SIG) was made possible by the...

Leadership Masterclass Series 2023 4th October 2023

Following the summer recess, we’re delighted to announce the continuation of the 2023 Leadership...

AI expert confirmed as fastTrack keynote speaker 2nd August 2023

CEO of Satalia and chief AI officer for WPP, Dr Daniel Hulme, will be a keynote speaker at Airmic’s next...

The FSO Safer insurance deal: A ticking time bomb – Howden broker interview 2nd August 2023

A decaying tanker off the coast of war-torn Yemen represented an ecological time bomb, until a London...

High inflation is having broad implications on the insurance sector. 2nd August 2023

Airmic hosted a roundtable, under the Chatham House rule, about the recent effects of high inflation on the...

AXA XL launches Excess Emissions insurance product 2nd August 2023

AXA XL has launched an Excess Emissions Insurance product to help marine insurance clients manage their...

The digital age will give lawyers plenty to think about – Airmic CEO 2nd August 2023

Airmic CEO Julia Graham appeared on a podcast hosted by Howden.

Martyn’s Law to impact casualty pricing across next two-to-three renewals – Aon 2nd August 2023

The UK’s incoming Protect Duty legislation – also known as Martyn’s Law – has the potential to drive up...

Prepare to protect – Pool Re hosts Martyn’s Law webinar 2nd August 2023

The Protection of Premises Bill, otherwise known as Martyn’s Law, was the topic of a recent webinar hosted...

The Airmic Excellence Awards return for 2023 2nd August 2023

The Airmic Excellence Awards will return to the Annual Dinner on 5 December 2023.

Is technology the next big disruptor for captives? 2nd August 2023

One stand-out evolution of the Airmic Conference exhibition hall since our ‘return’ post-pandemic has been...

Market hedging, non-aviation risks driving captive conversations among airlines 2nd August 2023

Captive formation activity has been slow going for airlines, with large, established carriers benefitting...

Regulatory trends, evolving risk profiles prompt update to Captive Governance Guide 2nd August 2023

Airmic published an update to its Captive Governance Guide at Conference, with additional insight on...

Using captives for ESG risk? How to get it right 2nd August 2023

“Can we insure ESG risks and does it make sense to use our captive?” A question risk managers are facing...