Airmic runs a blend of online and face to face sessions. Where workshops are to be delivered online, these are marked as ONLINE in the list below. All other sessions will be face to face sessions. All sessions can be registered for by clicking on the link for the relevant session. Live sessions are listed below and on the calendar to the right

On Demand sessions covering a wide range of topics can be found in the Library section of the website.

Sessions and events from Airmic with a specific insurance focus and accredited by the CII are indicated below against relevant sessions under 'More Info'.

Next Session:

In today’s rapidly evolving digital landscape, cyber threats are becoming increasingly sophisticated and frequent. Businesses of all sizes face the challenge of protecting their data, systems, and reputation from cyber risks. This webinar will explore the critical role of dynamic cyber insurance in safeguarding organisations against these threats, while also providing insights into risk management strategies and emerging trends in cybersecurity.

Future Sessions:

Dispute resolution provisions in policies are rarely given the attention they deserve. We will explore the different processes and explain the effects of choice of law, jurisdiction and the new Arbitration Act 2025. We will also highlight some potential drafting issues, empowering you to navigate and assess these provisions.

Join Hogan Lovells for an interactive roundtable with Airmic members where we'll explore practical D&O insurance issues, including coverage, exclusions, managing D&O renewals and claims notifications as well as exploring the protection afforded by D&O policies for emerging risks, such as AI. The session will also facilitate collaborative discussion of current challenges and best practices for directors and officers.

Every successful organisation runs on a business model that defines, creates, delivers, and captures value. Suppliers, employees, and other partners fuel value creation — but customers are where that value is realised. The organisation then captures residual value to reward investors, pay taxes, incentivise leadership, and reinvest for growth. Each element is interconnected, and risk professionals have a unique opportunity to engage with every part of the model to drive resilience and performance.

In an era marked by unprecedented challenges in the risk landscape, the imperative for effective risk management information system (RMIS) solutions has never been more critical. Organizations today face a complex array of risks, compounded by data silos and integration hurdles that traditional RMIS platforms are ill-equipped to address. These challenges underscore the necessity for RMIS solutions that not only integrate seamlessly across diverse functions but also enable a more proactive approach to risk management.

True business acumen goes beyond understanding finance — but financial literacy is where it begins. Knowing how to read financial metrics, speak the language of finance, and spot issues early builds credibility and influence with finance peers. While this module won’t make you a finance expert, it will give you the insight and direction needed to strengthen your financial understanding and identify areas for further learning.

Digital transformation — powered by AI and emerging technologies — is no longer optional; it’s essential. Advances in data, automation, and digital capability are redefining customer experience, reshaping business models, and driving new efficiencies. For risk professionals, this transformation offers both challenge and opportunity: to engage strategically, tactically, and operationally with the digital ambitions of their organisations — and to harness technology to enhance risk insight and decision-making.

The world of work is evolving faster than ever — reshaped by technology, shifting expectations, and new ways of working. Organisations now face a complex mix of people-related risks, from engagement and retention to well-being and trust. To protect value and sustain performance, businesses must unlock the full potential of their greatest asset — their people — through effective talent management, strong culture, and strategies that foster psychological safety and resilience in an unpredictable world.

Boards play a pivotal role in driving long-term, sustainable business success — spotting opportunities to create and preserve value while overseeing the identification and mitigation of risks. Risk-taking fuels growth, but the impact of poor risk management is often underestimated, and cultural barriers can prevent leaders from fully engaging with risk. With ESG (Environmental, Social, & Governance) sustainability now at the heart of business strategy, organisations must understand the risks of weak governance and the opportunities to enhance their environmental and social impact. This shift elevates risk professionals from the background to a strategic, high-impact role.

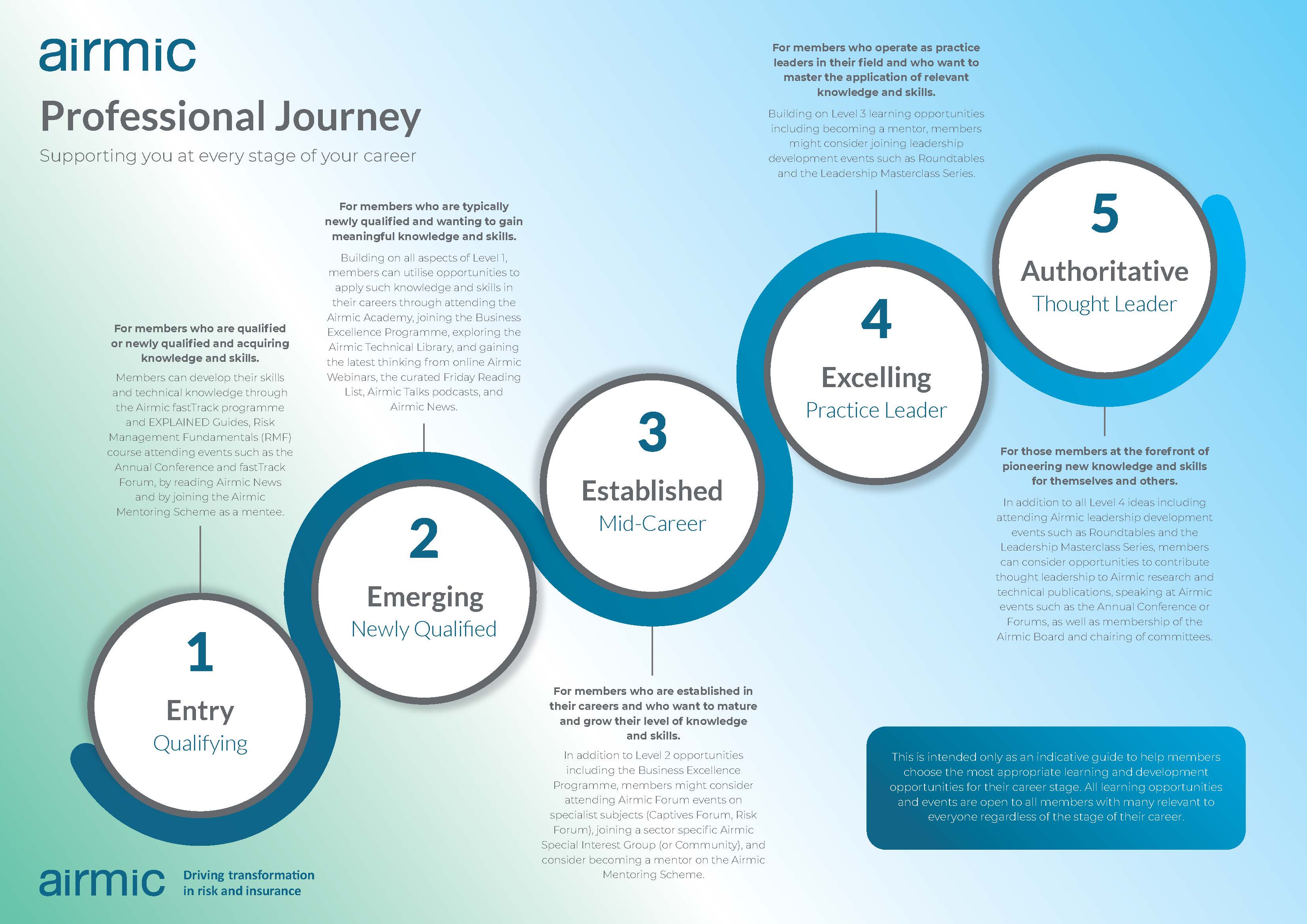

Airmic promotes and supports the planning, undertaking and subsequent recording, of Continuous Professional Development (CPD). Airmic activities offer a range of opportunities to undertake structured and unstructured CPD designed to help professionals build confidence and credibility, adapt to change through continuous skill development, increase productivity, and focus on relevant training and development to support career goals and address gaps in experience, skills and knowledge.

Subject to the CPD scheme an individual belongs to, many Airmic activities are eligible for CPD hours and points, and we would recommend hours are logged accordingly to present as CPD evidence should it be needed to. Wherever possible, Airmic will highlight the potential CPD hours / points available against its relevant activities

A Masterclass Series designed specifically for members holding senior roles in their organisations and wanting to explore the very latest thinking on leadership with peers at four events across the year.

A series of online sessions from experts in their field, designed for those in the first four years of their career (although open to all Airmic members) in order to provide a fundamental understanding of, and key competencies in, the principles of risk and insurance management.

A programme designed for the risk professional who is ready to use a foundation of qualifications and experience to move them forward to the next stage of their career.

A series of online webinars exploring the latest news and thinking on key emerging topics throughout the year. Watch this space for developments for 2026.

Free to members, Airmic Field Trips are designed to offer members the opportunity to experience the work of organisations pushing the boundaries of innovation.

Airmic's mentoring scheme is perfectly designed to help members develop their professional skillset, network with peers, and learn new skills and techniques to improve and grow in their careers.

Airmic is proud to work with selected affiliated providers delivering programmes relevant to Airmic members. Airmic has been able to secure discounts for members where possible.

In collaboration with Airmic, two professional qualifications developed by the Sagacious Group of experienced insurance professionals in conjunction with the Guernsey International Insurance Association (GIIA) and the GTA University Centre.