Swiss Re: Global fragmentation is widening protection gaps

Latest Sigma research warns of slowing global growth and reduced international cooperation.

The long-term shift towards the fragmentation of economies and markets poses a serious risk to the efficiency, availability and cost of insurance, according to Swiss Re in its latest Sigma research, World insurance in 2025: a riskier, more fragmented world order.

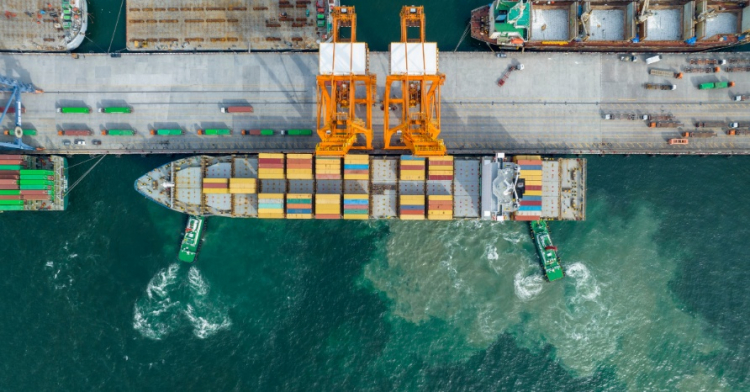

Less efficient global supply chains, stagflationary headwinds for the U.S. economy, growing U.S. isolationism and a re-escalation of political tensions in the Middle East are heightening global risk at the same time as hindering the insurance industry’s capacity to absorb risk globally.

“Trade barriers and supply chain disruptions or reshoring may push up inflation for prolonged periods, feeding into higher claims costs,” the report notes.

It continues to say that restrictions on free capital flows for re/insurers “can lead to inefficient capital allocation, higher capital costs, and higher insurance prices, possibly curtailing insurability of peak risks.”

Political fragmentation is also proving a barrier to international cooperation on major issues such as climate change, pandemics and cyber risks, thereby increasing global exposure to these risks. The report warns that society ultimately bears this cost:

“The impact would be felt both in insurance affordability and availability. Companies and individuals could have less coverage and as a result be less resilient. This may further widen existing protection gaps from already high levels.”

Commercial rates continue to soften

The rate of global growth is slowing, hindered in part by political volatility and ongoing tariff uncertainty. Swiss Re now forecasts global GDP growth to slow to 2.3% in 2025 and 2.4% in 2026, adjusted for inflation, down from 2.8% in 2024. Growth in advanced markets is forecast to be down 40 basis points this year, at 1.3%.

Turning to insurance rates, Swiss Re forecasts that global insurance premiums (life and non-life combined) will grow by 2.2% in real terms annually over the next decade, largely driven by emerging markets.

The reinsurer predicts that premiums in the commercial sector will continue to soften; however, tariff-driven claims uncertainty and above-trend natural catastrophe losses are likely to “put a floor under rate softening.”