Insurance Act has had “positive” impact on placement, say Airmic members

However, survey suggests use of conditions precedent is rising.

The Insurance Act 2015 has achieved many of its desired outcomes and had a positive impact on the placement process, according to a survey of Airmic members, ten years after the Act achieved royal assent.

The Act was regarded as a major piece of legislation, bringing commercial insurance law up to date with the realities of the modern world. Airmic was a major player in bringing the Act into force, working closely with key industry players and lawmakers.

It was designed to combat the imbalance in law that was perceived to favour insurers, and was broadly welcomed by Airmic members and insurers alike.

“I am pleased to see that the survey results show that the Act has had a positive impact on placement with policyholders reporting greater engagement with their insurers on the disclosure process pre-inception,” commented Fiona Treanor, partner at law firm Herbert Smith Freehills Kramer, who produced the report with Airmic.

Airmic member Ben Cooney, director in insurance & risk management at Avison Young, also welcomed the findings. “The survey results provide a measure of reassurance about the practical impact of the legislation and reinforce confidence in the stability and fairness of the current claims environment.”

As well as better engagement, the results show that many of the perceived concerns about the Act have not materialised. For example, the number of disputes between policyholders and insurers has not significantly changed, and there is no evidence of insurers trying to contract out of the Act.

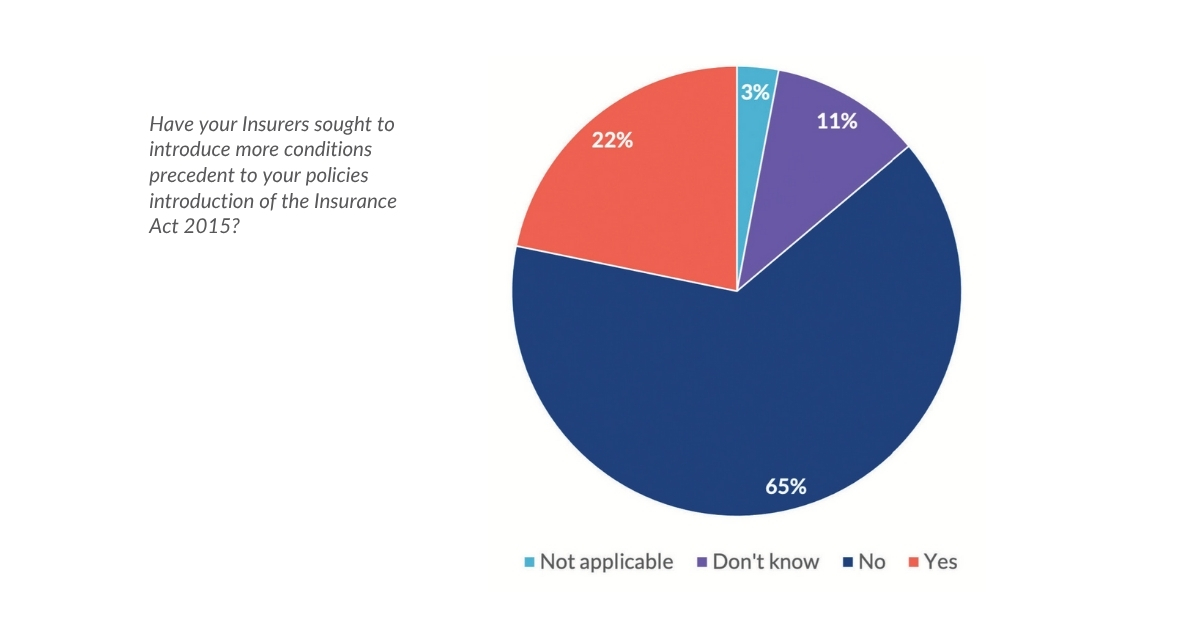

However, some of the results suggest there may be an increasing use of conditions precedent in policies. A breach of a condition precedent can have serious consequences for policyholders, leading to coverage not attaching or to a claim being denied, irrespective of whether the breach impacted the claim.

“An increase in their use may be cause for concern, particularly if insurers are using conditions precedent to circumvent the various other policyholder protections introduced by the Act,” the report warns.

Read the results and analysis in full by downloading 10 Years of the Insurance Act 2015