Insurance Act 2015

Introduction

The Insurance Act is the most fundamental change to the law of England and Wales, Scotland and Northern Ireland governing commercial insurance and reinsurance since the Marine Insurance Act 1906. The Act, which will govern polices placed, amended or renewed after 12th August 2016, makes amendments to the Marine Insurance Act 1906 to reflect modern commercial practice. The Act aims to address the imbalance between insurer and insured rights by making significant changes to several areas, including the following:

-

The duty of disclosure and the remedies available to the insurer in the event of material non-disclosure and misrepresentation

-

The interpretation of warranties and terms not relevant to the loss

-

The abolition of Basis of Contract clauses.

Risk and insurance managers are strongly in favour of the provisions of the Act. In advance of its preparation, 97% of Airmic members advised that they fully supported the need for legal reform of the Marine Insurance Act 1906 (Airmic Duty of Disclosure and Misrepresentation survey, 2012), and 85% of Airmic members advised that the new disclosure requirements and insurer remedies are good news for policy holders (Airmic Insurance Act 2015 - Are you ready? survey, 2015).

Although the Act intends to move insurance law to a position that is more favourable to the insured, it is critical that policyholders fully understand its implications. Insureds must begin considering and preparing for the new ‘duty of fair presentation’, which provides clarity to the type of information a policyholder must provide to the insurer before entering into an insurance contract.

This paper aims to outline the challenges of fair presentation and identify steps that Airmic members can take to prepare for August 2016.

Insurance managers must take control of understanding the duty of fair presentation

At the time of writing, the primary focus of the market is on ensuring that policy wordings comply with the provisions of the Act. Insurers and brokers are beginning to release guidance on how the process of disclosure will take place. However, over 50% of Airmic members report that they have received no information on the duty of fair presentation from their broker or insurer (Airmic Insurance Act 2015 - Are you ready? survey, 2015).

Airmic recommends that members are proactive in taking control of the review of their insurance disclosure processes from the outset and that they do not wait for their brokers or insurers to release information.

Group Insurance Manager, Support services firm: ‘There appears to be a wide range of knowledge and information currently available on the provisions of the new Act. However, in the absence of any proper detail on how the new Act will be applied in practice, there may be some misunderstanding and misconception amongst certain insureds that there is no need to take action before August 2016, if at all. The repercussions that ensue may be significant.’

Structure of the paper

This paper builds on two Airmic briefings – The Insurance Act 2015: what members need to know (which can be found in Appendix 1 of this guide) and The Insurance Act 2015: Taking Advantage of the Insurance Act’s benefits now. Here, Airmic aims to break down the duty of fair presentation and suggest how members can review their own internal processes when considering their own compliance with this duty.

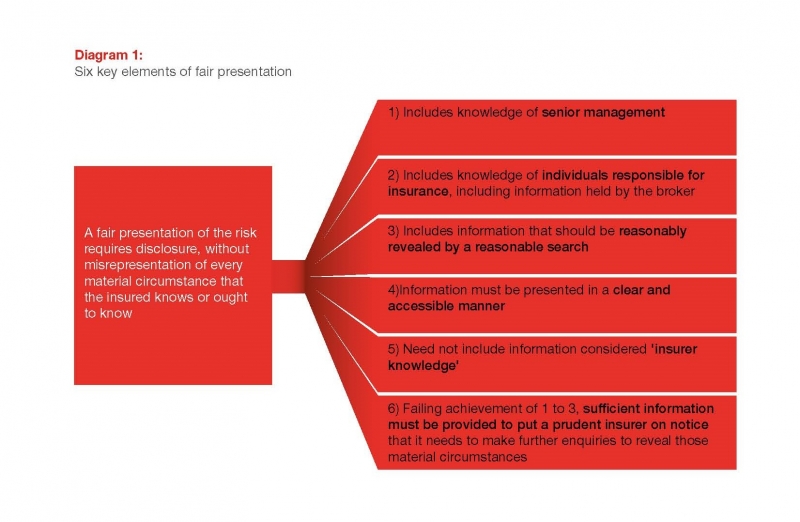

Diagram 1 breaks down fair presentation into six components highlighted by Airmic members as particular areas of concern. This paper looks at each component in turn and suggests key issues that Airmic members should consider when reviewing their own compliance with the duty of fair presentation.

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.