The Harsh Market: D&O and Renewals focus

The Harsh Market

DOWNLOAD THE FULL GUIDE PDF HERE

Airmic is conducting a series of Pulse Surveys among its members, focused on insurance market conditions. The latest survey conducted in August 2020 focused on Renewals and D&O business, and found a continuing deterioration in the member renewal experience that goes beyond market prices.

The commercial non-life insurance market has hardened and continues to harden. Rates have risen exponentially, in many cases regardless of a clear claims history and proactive risk management. Limits have been lowered and deductibles raised. Terms have tightened, and risks and sectors have been targeted with limitations and exclusions – all as organisations grapple with the Coronavirus crisis and economic downturn.

The August Pulse Survey canvassed some members of the leadership group within Airmic’s membership community of risk professionals and insurance buyers. The research ran over two weeks between 7 and 20 August, and asked 15 questions.

Each Pulse Survey comprises a combination of questions designed to track market conditions, supplemented by a focus on specific subjects. In the latest survey, the questions focused on recent and upcoming insurance renewals, and specifically on directors’ and officers’ liability (D&O), a class of cover that has experienced some of the most dramatic recent changes in rates.

Four headline findings included: a need for stronger communication and improved use of existing data; dissatisfaction at sudden, extreme and unexplained changes to rates and terms; resultant increased interest among buyers for captives and alternative risk transfer solutions; and a desire for change in the renewals process in future.

Better communication

The study revealed some serious challenges for brokers and insurers to consider in their relationships with clients, particularly dissatisfaction with service and communication.

Given the different factors that combined to form the harsh market, a sensible place to start is the overall impressions of performance. Almost two-thirds (65.0%) were only somewhat satisfied with their insurer’s performance in 2020; another 16.7% said they were very satisfied; and 18.3% stated they were not satisfied.

Brokers fared somewhat better. Just over one-third (35%) described themselves as “very satisfied” with their insurance brokers; some 55.0% were “somewhat satisfied”; while 10.0% admitted to being “dissatisfied”.

Hard market

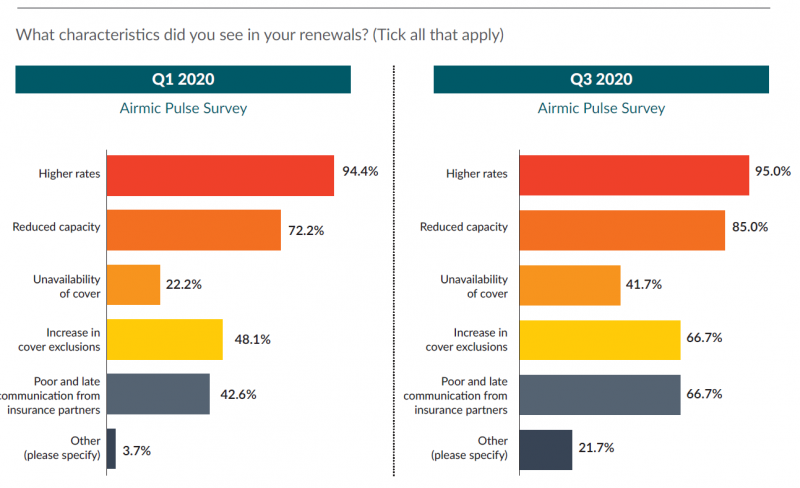

The traditional measures of a hard market are present and being felt across the board: higher rates, more exclusions, and tighter terms and conditions. When asked to tick all that applied, 95.0% of respondents observed higher rates and 85.0% witnessed reduced capacity from their insurers. Exactly two-thirds (66.7%) cited an increase in exclusions, while 41.7% noted problems finding coverage available.

These trends continued from the last survey, although some deteriorated more than others. For example, instances of respondents citing cover being unavailable almost doubled from 22.2% in the previous study. Likewise, the rise in exclusions was highlighted in its jump from 48.1% to 66.7%.

Poor and late communication from insurance partners figured in both surveys. Some 66.7% made this complaint in the most recent survey, a rise from 42.6% last year. This running theme is perhaps among the most disappointing findings for insurance partners that pride themselves on relationships.

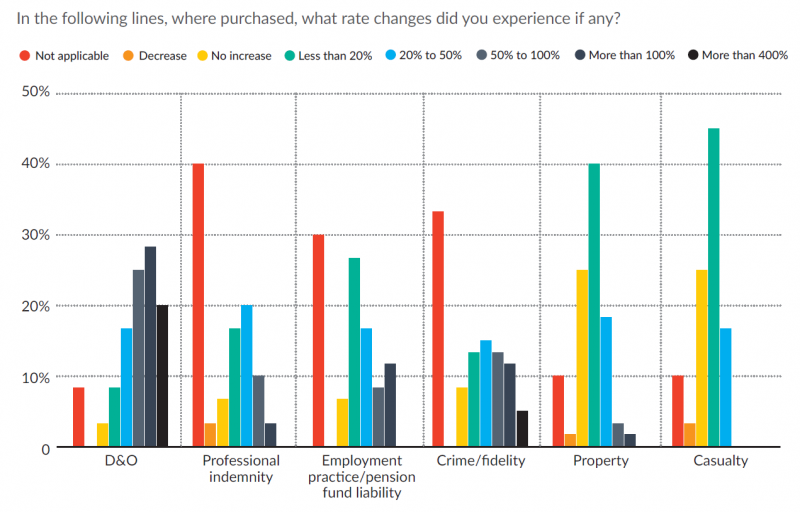

Rate rises were less surprising, but the scale of the price increases was nonetheless dramatic. Broken down by class of business, D&O saw the most exponential rise in pricing. A fifth of respondents said they had experienced a rate increase of more than 400%.

A majority experienced D&O premium rate rises of at least 50%, and almost 30% reported that rates had doubled. The situation follows similar but less pronounced price rises observed in our last market survey in February, highlighting the scale of the rate hikes.

For professional indemnity insurance, as well as for crime and fidelity related policies, the most common level of rate increase was between 20% and 50%. For property, casualty, and employment practice or pension fund liability business, the most common result was an up-to-20% increase in pricing.

Taking D&O as a case study, 30.0% described the quality of service provided by their insurer as good, and 6.7% thought it was excellent. However, another 30.0% said they had experienced poor or very poor service.

Taking D&O as a case study, 30.0% described the quality of service provided by their insurer as good, and 6.7% thought it was excellent. However, another 30.0% said they had experienced poor or very poor service.

Brokers fared better, with three-quarters of respondents at least satisfied with service from intermediaries while buying D&O covers; a majority thought it was good or excellent; but some 13.3% said service was poor and 3.3% said service was very poor.

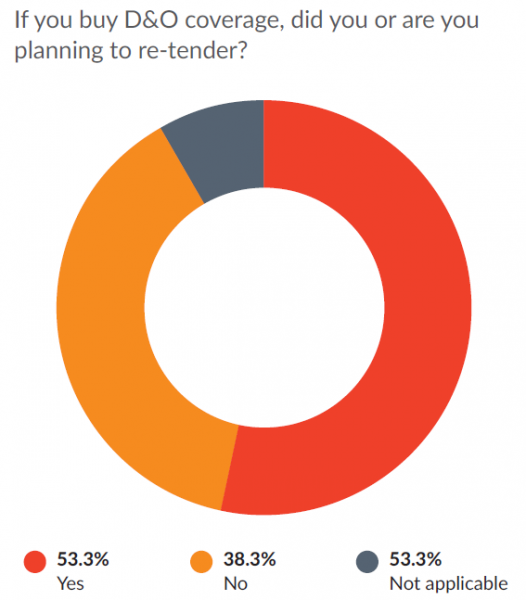

For those seeking to buy D&O coverage, just over half (53.3%) had already or were planning to re-tender. Similarly, just over half of the respondents had also experienced a lack of timely communications, especially on pricing.

Captive audience?

Of the survey’s respondents, exactly half said their organisation already operates one or more captives. When asked whether they would consider setting up a captive, if their organisation didn’t already have one, 20.3% of the overall group said they were thinking it over.

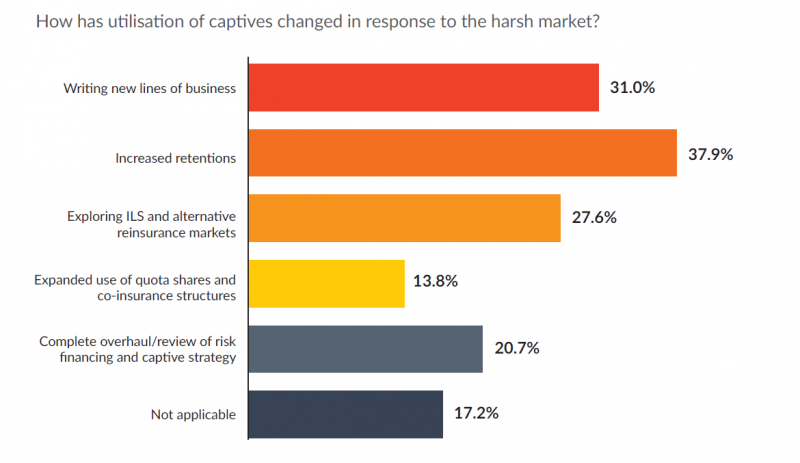

The research also asked how the hard market is changing the way organisations utilise their captives.

Some 31.0% said they were writing new lines of business; 37.9% were using captives for increased retentions; 27.6% were exploring alternative re/insurance markets, such as insurance linked securities (ILS); 13.8% had expanded their use of quota shares or co-insurance structures; and 20.7% had undertaken a complete overhaul or review of their risk financing and captive strategy.

For Side A coverage (i.e. protection for individual directors where a company cannot or has refused to indemnify them), 10.3% are considering using a cell captive solution and the same proportion are mulling over self-funding mechanisms.

For Sides B and C coverage (i.e. to reimburse an organisation after having defended or indemnified a director, typically reserved for publicly listed companies, and to protect the corporate entity from its own liability exposures, respectively), 42.9% were considering placing such protections within their captive and 3.6% said they would consider other options for funding mechanisms.

Plans for the future

Asked to describe their claims experience in 2020, a slight majority (53.3%) were very satisfied, while the remainder were only somewhat satisfied, and 11.7% were dissatisfied by their claims experience.

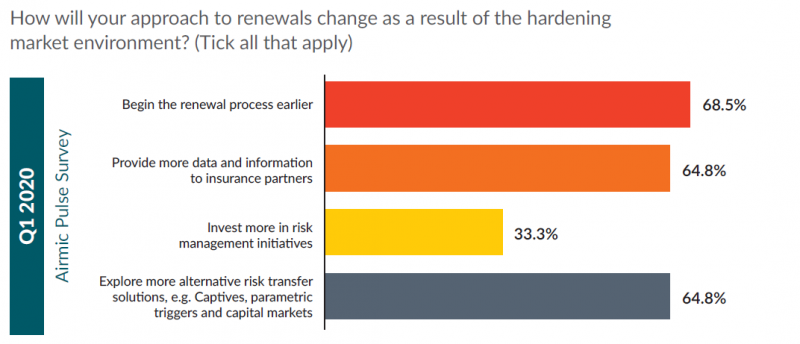

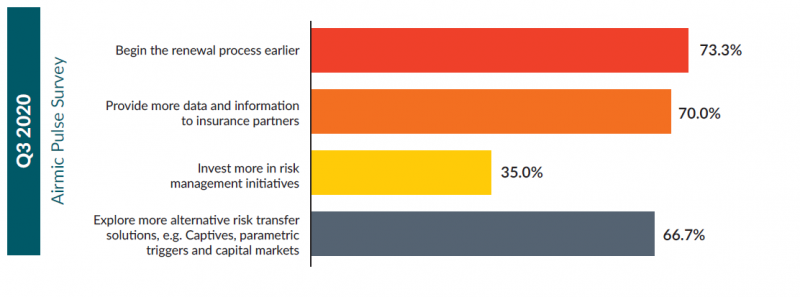

Asked how their approach to renewals will change amid the hardening market in the second half of this year, the results suggest organisations are more open-minded than a year ago.

Some 73.3% said they would seek to begin the renewals process earlier and 70.0% wanted to provide more data and information to their insurance partners.

Another 35.0% said they would invest more in risk management initiatives, while 66.7% said they would explore the use of alternative risk transfer – captives, parametric triggers, capital markets – as opposed to traditional insurance.

Risk professional conclusions

Airmic asked risk professionals and insurance buyers for their views on the issues contained in the survey, producing further insights into the problems faced not just by buyers but by the insurance market.

For Tracey Skinner, Chair of Airmic and Director of Insurance and Risk Financing at telecoms giant BT Group, the focus is on improving communications and sending additional data for the insurer to consider, beyond just what is required or one level up from that.

"I don’t think you can underestimate the importance of providing the insurance market not just with the ‘nice to have’ data when we put data packs together, but things that are a lot more precious, the ‘dream team data’ that the market would really like to have,” Skinner said.

“In a hard market, we need to move towards that as much as we can. Having your own unique data relating to the risks involved is going to put you in a stronger position,” she added.

Skinner also pointed to the problem of broker inexperience in a hard market, made worse by problems of remote working negotiations with underwriters during 2020 lockdown conditions.

“We’ve gone from very a soft to a hard market very quickly. A lot of brokers have never operated in a hard market before. They’ve become accustomed to lazy buying and lazy broking, and it’s hard to turn that around overnight,” said Skinner.

For Josh Cryer, Head of Risk and Insurance at airline Virgin Atlantic, strategizing the renewals process, particularly for D&O in a hard market, has become almost an all-year-round continual cycle.

In 2020’s harsh market, the rationale behind sudden rate changes is not being communicated properly, he emphasised. That is leading to organisations that are able to demonstrate effective risk management being punished by market-wide pricing decisions regardless of their individual efforts.

“If you continuously demonstrate that you’re improving your risk profile, demonstrate that you’re listening and demonstrate that you’re doing what you say you’re doing, you want to be rewarded at the back end of that, and not be pooled, as clients are in some instances, because you’re in a certain sector so you’re going to get that price,” said Cryer.

“Insurers and brokers need to be constantly challenging us as risk managers,” he continued. “The insurance industry was built on people being able to make good decisions by having open and honest negotiations. I think this will be the driver going forward, or it will be telling whether it continues or not.”

He also underlined the importance of brokers allowing risk managers to converse directly with insurers, particularly as in tough negotiations, it can require C-suite involvement in negotiations.

“The better brokers will allow risk managers to communicate and converse directly with insurers so that they can articulate the risk effectively, which can then be followed up on for those renewal negotiations.”

The need for direct dialogue between buyers and insurers was underlined by Scott Feltham, Group Insurance Manager at catering company Compass Group.

“Now more than ever it’s absolutely critical that the market understands the true nature of the risk, and perhaps more importantly to understand what your organisation may be doing to set yourself apart from the rest,” Feltham said.

“For that purpose, I would absolutely urge buyers of insurance to conduct one-to-one meetings with certain key carriers. The difficulty is that, in the current environment, one-to-ones can only be held virtually, which doesn’t have the same effect,” he added.

We’ve gone from very a soft to a hard market very quickly. A lot of brokers have never operated in a hard market before. They’ve become accustomed to lazy buying and lazy broking, and it’s hard to turn that around overnight. Tracey Skinner Chair of Airmic and Director of Insurance and Risk Financing at BT Group

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.