EXPLAINED: How to make the most of the Insurance Act 2015

1 Introduction

This EXPLAINED guide consolidates and updates existing Airmic guidance on the Insurance Act ("The Act"); to assist risk managers in making the most of the benefits of the Act, whilst ensuring their own compliance with the new duties placed upon them.

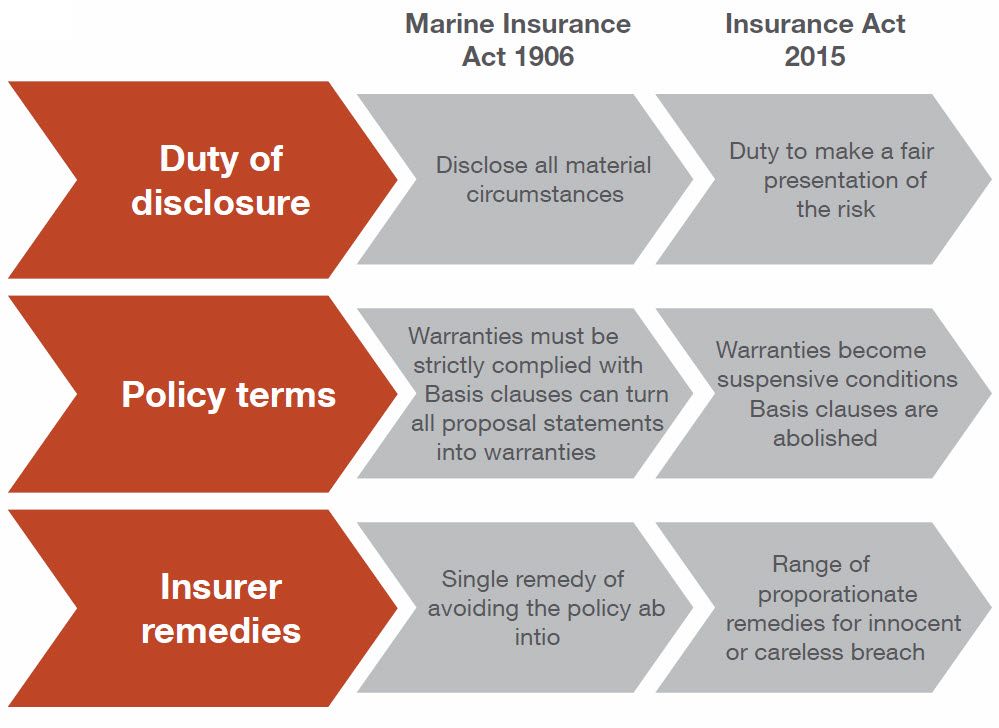

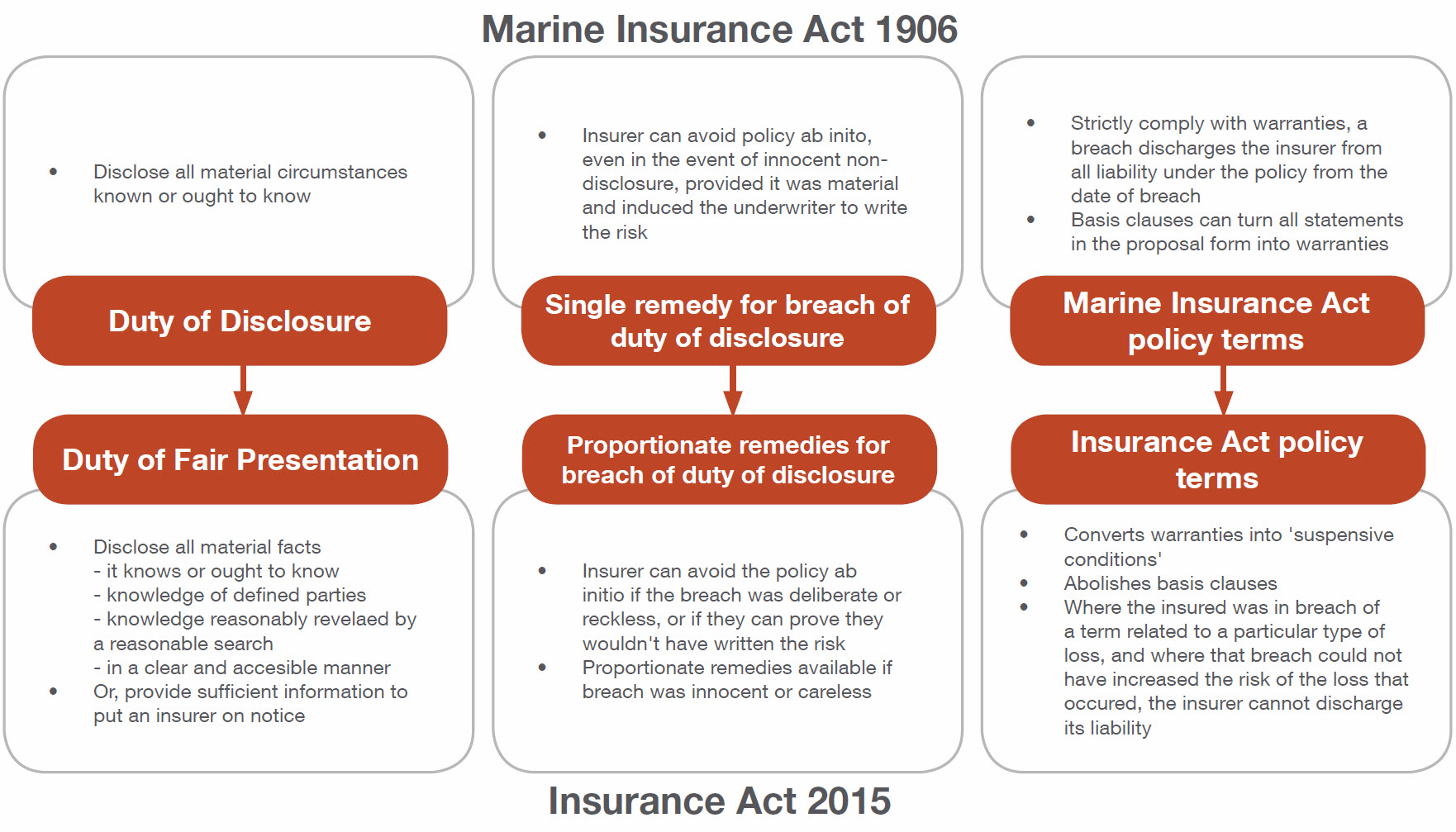

The Act is the most fundamental change to the law of England and Wales, Scotland and Northern Ireland governing commercial insurance and reinsurance since the Marine Insurance Act 1906. The Act governs all polices placed, amended or renewed after the 12th August 2016 and aims to address the imbalance between insurer and insured rights and encourage a deeper understanding of the risk by all relevant parties.

The Act makes significant changes to: the duty of disclosure, insurer remedies in the event of material non-disclosure and misrepresentation, insurance policy wordings and has resulted in a shift in market practice since coming into force

- The Insurance Act 2015: What members need to know

- The Insurance Act 2015: Taking advantage of the Insurance Act’s benefits now

- The Insurance Act 2015: A guide to fair presentation

- The Insurance Act 2015: Paying additional premium instead of a proportional reduction in claims

- The Insurance Act 2015: 10 months on

The paper includes new content, provided by Herbert Smith Freehills, covered in

- The Insurance Act 2015: Guarding against the unfair consequences of a breach of a condition precedent to liability

Figure 1: Summary of changes made by the Insurance Act 2015

Parties can choose to contract out of the provisions of the Act (except for the abolition of basis clauses). Any policy term which would put the insured in a worse position than under the Act must comply with certain transparency requirements. This means that the term must be brought to the attention of the insured before the contract is entered into and must be clear and unambiguous as to its effect.

Policyholders must, therefore, ensure that care is taken in drafting any policy terms which seek to contract out of the Act. Helpfully, to the extent an insurer seeks to contract out of the Act, this should be clear from the wording and the effect of the term clearly stated. However, policyholders should be aware that an insurer can satisfy the requirement under the Act to bring such a term to the attention of the insured by bringing it to the attention of the broker.

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.