Silent cyber the focus of latest Airmic white paper

Airmic has collaborated with Lyndsey Bauer, Partner at specialist insurance broker Paragon to produce a white paper on how silent cyber issued have developed into coverage disputes.

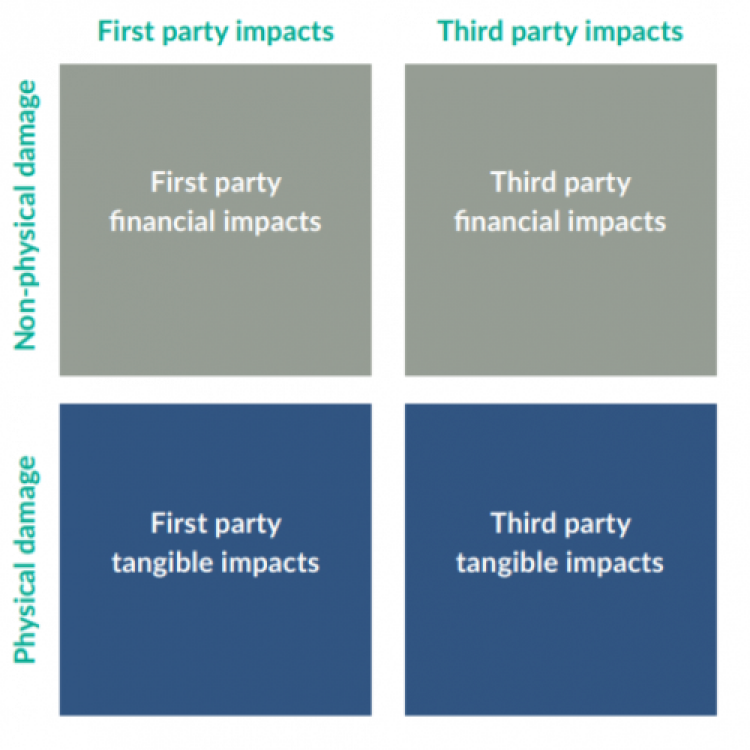

The paper discusses how while cyber risk impacts practically every line of commercial insurance, it remains unaddressed in many lines of insurance. The lack of clarity in some standard property and casualty policies, leading to confusion or misunderstanding about coverage for cyber risks.

“Insurers and regulators are taking action to address the risk of silent cyber,” says Ms Bauer. “Policy language is evolving and that is impacting coverage. Besides being untested, the drafted language could also overreach.

Policyholders face the challenges of getting inconsistent responses from their insurers, inadvertent loss of intended coverage and programme gaps. Finally, insureds should prepare for renewal – they should develop a strategy, identify renewal priorities, approach the market with C-suite support and always review feedback.”

The white paper, available in full on the Airmic website, leads with an overview of the current environment, including policy options for buyers, as well as potential arguments for insurers denying cover.

The document then describes the market response to silent cyber, including exclusions on directors’ and officers’ liability and on crime insurance products, property and marine affirmative covers, standalone cyber policies, providing options for insurance buyers.