Q&A: Mary O’Connor on mega trends, career advice and the next generation

The role of the risk manager is becoming harder but more interesting, according to Mary O'Connor, head of client, industry and business development at Willis Towers Watson: one of the keynote speakers at this month's fastTrack Forum.

Q: What does the future hold for today's young risk professionals?

Airmic's fastTrackers will need different skills to those currently in leadership roles. They will have to really understand the risks facing their business, not just know how to transfer them. In the future, risk managers will be helping boards take more risk in order to grow successful businesses. How they use insurance will also change as it becomes a wider financial instrument and more closely tied to the business model.

All of this will make the risk manager's role more challenging, but also more interesting. But they will have more tools at their disposal to help.

|

2018 fastTrack Forum The fastTrack Forum returns for 2018, 28 February, Willis Towers Watson offices, 51 Lime Street To hear more from Mary O'Connor and a fantastic line-up of speakers and workshops, book your place now:

|

All of this will make the risk manager's role more challenging, but also more interesting. But they will have more tools at their disposal to help.

Q: What new skills will this require?

The next generation will need to be confident using data and technology, and to be able to understand the interplay between risk and capital. This will require broader business skills and a solid understanding of other business functions. It will also require a strong focus on people skills – talent risk underpins so many of today's broader risks.

Q: What will you be discussing at Airmic's fastTrack Forum?

I will be talking about our Megatrends project [see box] and how this will shape the future of the profession.

The purpose of the Megatrends is to better understand risk by going beyond specific risks, and focusing on what is important now and in the future. They are the risks that we think the c-suite is most interested in and a useful lens for risk managers to look at the world. It enables conversations that are not just about insurance policies.

You can't predict the future, but there are a lot of big forces shaping it.

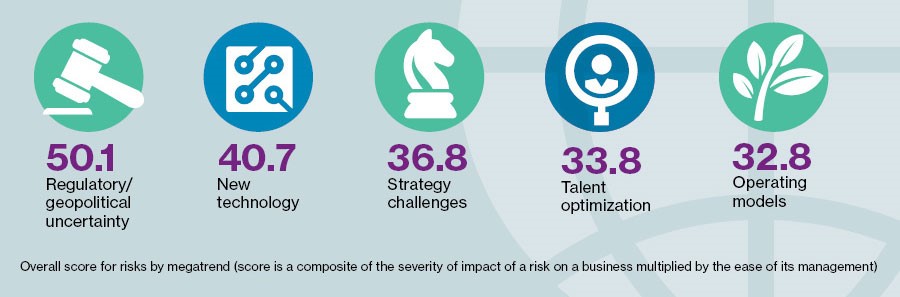

The five global risk megatrendsRanking is a composite of the severity of impact and the ease of management

Source: Willis Towers Watson |

Q: What career advice do you have for today's young risk professionals?

First, technology and data are not going away, and people are a constant in business, so these are the skills you need to focus on.

Second, educate yourselves on what the big questions facing businesses are. You don't need to know all the answers, but you do need to know the right questions to ask, and that is a skill in itself.

Third, don't be afraid of change: the future is really positive for risk professionals.