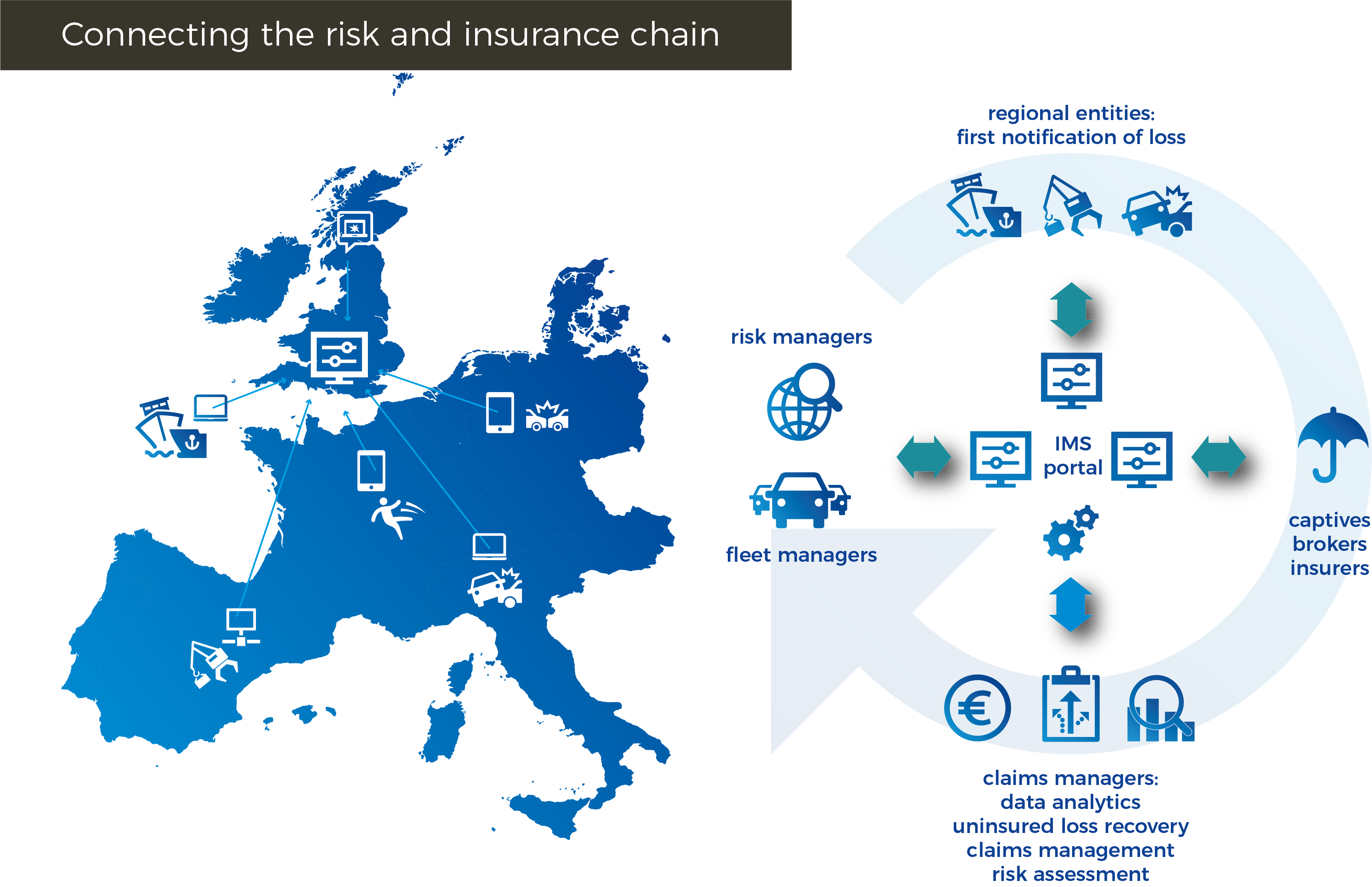

The missing link in risk management

How to create a common platform for claims in cross-border insurance programmes, encompassing all the diversity of data, notification systems and local regulations that this involves, is a perennial challenge for risk managers. It need not be, says Willem van der Hooft of Van Ameyde.

Risk managers whose beat covers multiple regions have a common complaint. In every location there is a different system, losses are processed differently, and the data generated is neither uniform nor complete. Time-consuming data cleansing is needed if any sense is to be made from the fragmented data. And still the question remains whether all losses are duly notified, handled and, if possible, recovered from liable parties.

As a result, risk managers struggle across the board with limited overview, and in the end, they have to base their decision making and risk management strategy on incomplete data.

The obvious solution is to move to a single platform, but a lot of companies are put off this approach by the work that appears to be involved. In the long run, however, it will save you considerable amounts of time and reduce your operational expenses.

Here are some tips for risk managers thinking of going down this route.

- Establish your exact needs (including in the area of reporting and analytics);

- Analyse the notification, triage and handling processes;

- Customise the look & feel of the FNOL (First Notification of Loss) platform to that of the customer;

- Test the system by key users;

- Set up reporting requirements which will also determine how the FNOL platform will be customised. You will need to register the right information at intake;

- Create and allocate user authority levels and then regularly evaluate and update.

(click to enlarge)

As a global car hire company discovered, the optimum solution is to move to a unified pan-European claims management platform. With hundreds of locations throughout Europe using different systems, management had no insight into its losses and the potential for recovery. An early step was to create a customised solution for FNOL, triage and recovery of uninsured losses.

Having standardised the notification and handling of incidents and claims across Europe, it became possible to identify areas for improvement, such as uninsured loss recovery, achieving savings of up to 20%. Around 80% of the work is now automated, further lowering costs and accelerating resolution times.

Today, the firm's data is consolidated, accurate and reliable, as a result of which risk assessment has vastly improved. Managers can view pan-European claims data in real-time. A complete picture of the losses incurred throughout the company is the basis for risk mitigation and helps risk managers make informed decisions on risk transfer and risk management.

Their data management, data security protocols and practices are fully GDPR-compliant.

Willem van der Hooft is business development director at claims specialists Van Ameyde