How visual evidence and AI technology are transforming risk management

Sophisticated imagery technology is giving companies and insurers unprecedented access to real-time data and situation awareness to protect assets and drive effective crisis response. Dave Fox of Geospatial Insight explains.

On 25 January 2019, an iron ore mine owned by Vale SA in Corrego do Feijao, Brazil, burst, polluting the Paraopeba river and causing the loss of hundreds of lives. The dam break released a deluge of mining waste that slammed into Vale's facilities and cut through a nearby community, leaving a wake of destruction stretching for miles.

This tragedy has raised the question of how companies can do more to safeguard their employees, protect their assets and maintain shareholder value. It has also put the spotlight on how technological advances can play a vital role.

One such technology is the use of sophisticated visual evidence to provide rapid, real-time data and situation awareness. Visual evidence technology can be used to calculate the scale and severity within 24-72 hours of the event taking place.

The image below of the Vale Dam disaster was captured by satellites and analysed Geospatial Insight's CAT response team which also provided an assessment of the potential damage or destruction of properties in the immediate region.

Images such as this allows the disaster response to be better equipped and to ensure the re/insurance support is appropriate. Whilst nothing can be done to alleviate the tragic loss of life, a speedy response and action with instant information and analysis can help to assess potential claims more accurately and get people and communities back on their feet more quickly.

Vale Dam, before the disaster

© Planet Team (2019). Planet Application Program Interface: In Space for Life on Earth. San Francisco, CA. https://api.planet.com

Vale Dam, after the disaster

© SuperView Satellite – distributed by SPACEWILL

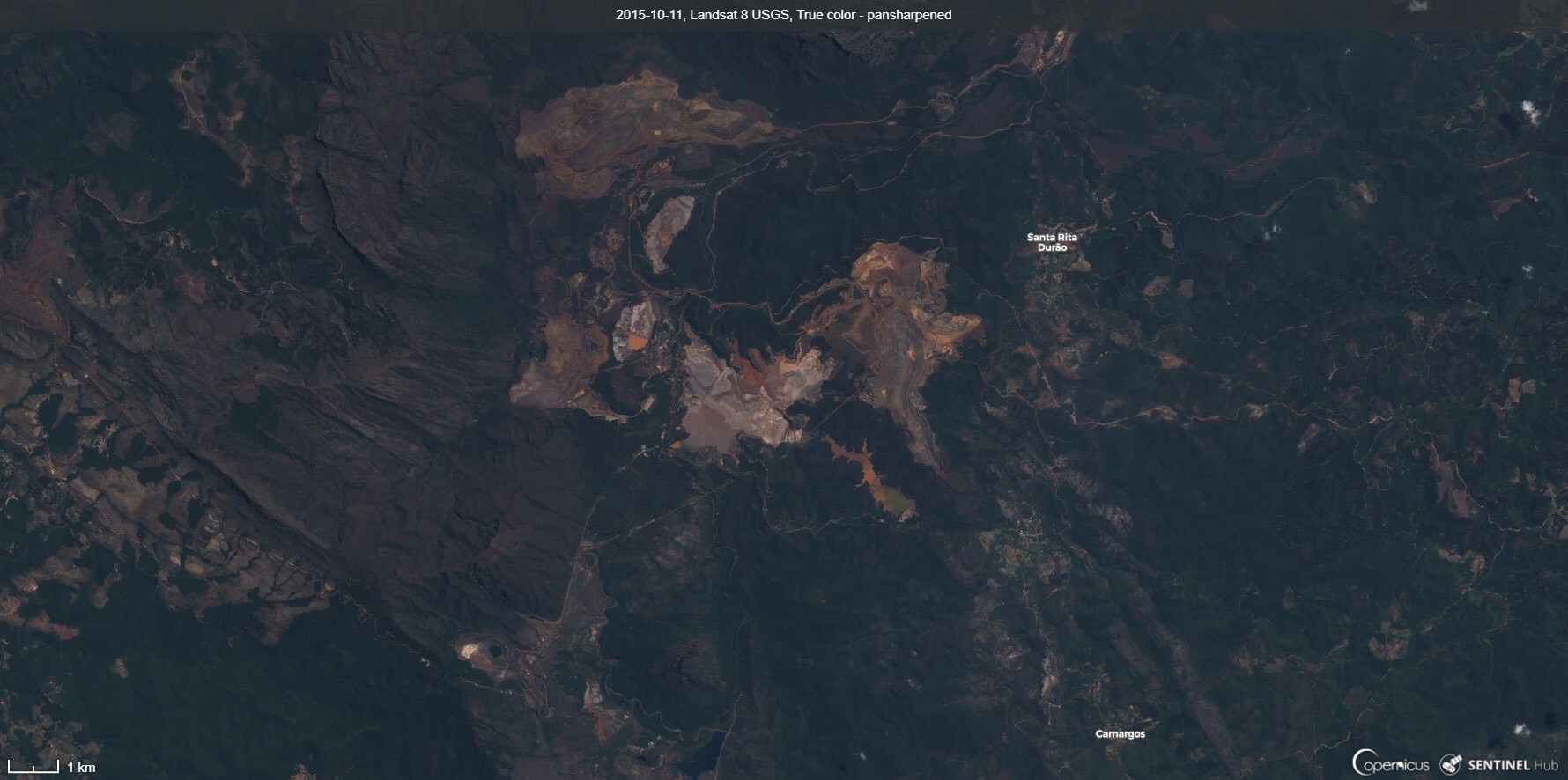

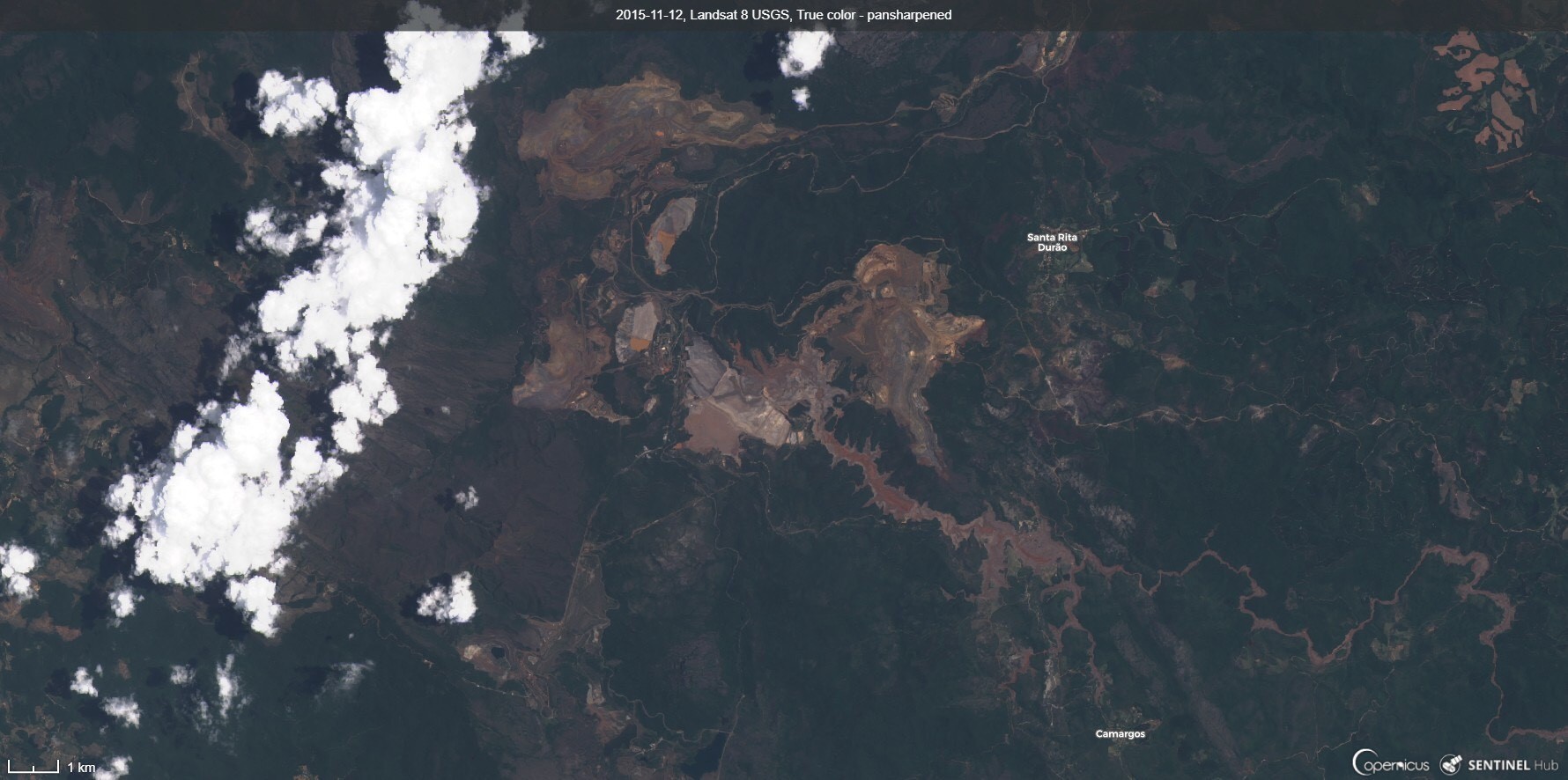

However, from a pre-risk perspective, continuously monitoring these assets can prevent these disasters from happening at all. Another example is the Fundao Dam disaster, which ruptured on November 5, 2015, and unleashed a torrent of water and sediment from iron ore extraction in a wave that polluted the water supply for hundreds of thousands of people, devastated wildlife and ejected a rust-red trail of mud down the Doce river.

In this instance, the insurers asked Geospatial Insight to trace images taken before the dam burst to see what had caused it to break. It is clear from the images below that there was an indication that the structure was being undermined and evidence that it was leaking in the days before the event occurred. Insurers are using this technology to better understand risks, prevent or mitigate losses, provide loss estimates, support claims and inform future modelling.

Fundao Dam before the rupture - click to enlarge

© Landsat-8 image 2015 courtesy of the U.S. Geological Survey, processed by Sentinel Hub

Fundao Dam after the rupture - click to enlarge

© Landsat-8 image 2015 courtesy of the U.S. Geological Survey, processed by Sentinel Hub

For companies with other types of large property assets, applying artificial intelligence and building analysis is critical for the carriers who are insuring those assets and conducting evaluations on their portfolios, which of course in turn drives the premiums. If changes are made to these assets during the course of the year, the insurers need to know about it.

Other imagery tools that offer a greater understanding of individual risks being written include subsidence products that detect whether ground movement is greater than expected in certain areas. Tree encroachment can be monitored to see whether properties or additions to properties are being built near roots that may undermine a property's foundations. Making sure the roofs of properties are being maintained properly to prevent leaks or floods helps mitigate costly repairs. Imagery combined with the use of AI analytics can automatically provide visual evidence and flag these changes to ensure businesses and carriers are always fully aware of the risks.

The use of visual analysis and analytics tools is increasing all the time as risk managers and the wider insurance community strive to better understand risk, price it more keenly, deliver bespoke coverage and most importantly, prevent losses from taking place. Having access to this insightful data and visual evidence makes interpreting risks much easier and more accurate and in turn enables risk managers to make better decisions.

Dave Fox is CEO of Geospatial Insight. Geospatial Insight will be showcasing their latest technology at Airmic's Tech Hub at the annual conference in June.