Turning emerging risks into strategic advantage

Nebulous, under-researched and constantly changing: managing emerging risks is both an art and a science. But in an era of polycrises and heightened speed of change, it is a core skill for today’s risk professionals. Businesses that stay ahead and adapt can gain a market edge – but what does good practice look like?

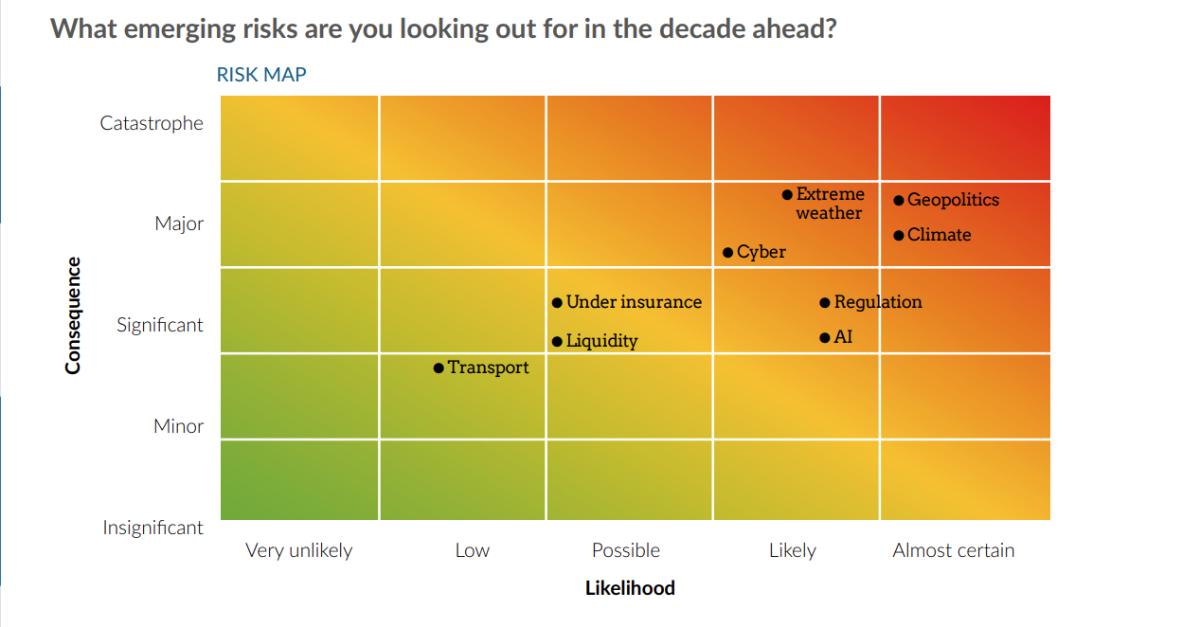

Unlike familiar operational or financial risks, emerging risks are characterised by deep uncertainty and limited data. They can manifest in many forms—technological disruption, shifts in regulation or geopolitical instability—and can unfold suddenly or evolve over decades.

Crucially, these risks go straight to the heart of strategy. They can reshape business models, redefine competitive advantage or require a fundamental rethink of long-term opportunities. Handled poorly, they threaten resilience; handled well, they can unlock strategic upside.

The expanding role of risk professionals

The concept of emerging risks is not a new phenomenon, but it has gained a higher profile in the past five to ten years. The combination of heightened global volatility, major shocks such as the Covid pandemic and Ukraine war, and the faster pace at which risks materialise due to technological developments has made businesses more alert to the unique demands of managing these risks.

“Recent events have further refined our thinking about emerging risks,” explains Hoe-Yeong Loke, Airmic’s head of research and co-author of Airmic’s emerging risk guide published this year. “They are not ‘Black Swans’, which are rare, high-impact events that come as a surprise. They are developments that we know a bit about but don't have adequate information.”

The role of the corporate risk professional has never been more vital. In today’s volatile environment boards increasingly expect risk leaders to anticipate and interpret the signals of change.

That means not only identifying threats but also framing them in terms of strategic implications and potential value creation. “The question for risk professionals, therefore, is how do they manage this risk in an information and data vacuum? This is a common question our members ask us,” adds Loke.

Airmic’s guide to emerging risk: what is good practice?

In response to member demand for more guidance on managing emerging risk, Airmic worked with risk consultancy Barnett Waddingham, to produce a practical guide to emerging risk, published at its annual conference in Liverpool. It includes a framework for assessing, monitoring and managing emerging risks.

“Emerging risks demand a different approach to traditional risks,” says Keith Smith, senior risk consultant at Barnett Waddingham, and co-author of the report. “What is considered an emerging risk will vary from company to company and one organisation’s disruptor may be another’s opportunity. But our guide draws out the broad principals and structures that can be applied by all businesses.”

Key action points highlighted in the guide, which can be downloaded here, include:

- Horizon scanning and scenario analysis: A lack of robust data renders many traditional risk management techniques unworkable. Businesses should therefore be more creative and qualitative in their assessment of the risk. “It is foolhardy to predict and prepare for a specific manifestation of a risk when the probability of that happening is so low,” explains Loke. “Scenario analysis and building the tools to deal with a variety of outcomes is a more effective approach. It develops muscle memory and agility, which supports the business response to a range of outcomes.”

- Consider behavioural change: Most risks do not have a material impact until they change the way people behave, whether they are customers, employees or shareholders. “Not every new technology or disruption matters unless it changes behaviours. If a risk doesn’t change behaviours, what impact has it had?” challenges Smith. In 2010, for example, the launch of 3D TVs, hyped as the next big thing, were seen as a major threat to broadcasting and content formats. In reality, however, consumer behaviour barely shifted and the theoretical risk did not materialise. “Predicting behavioural patterns is extremely challenging but the range of possibilities must be considered,” adds Smith.

- Communicate and educate the board: Emerging risks can feel abstract or remote. Clear, concise communication—framing issues in terms of strategic objectives—ensures boards engage early. “Learn to communicate about what emerging risk really is for your organisation and develop a consistent language across the business. Whereas risk professionals like to categorise and be methodical about risk, boards often consider it more holistically and intuitively.” says Smith.

- Bring in diverse perspectives: Younger generations, people with different cultural identities and voices beyond the executive team often spot shifts earlier and casting the net wide improves foresight. Smith believes that leadership teams that proactively engage Gen Z employees, for example, are better equipped to assess the potential impact of emerging risks. “The people running our businesses, with 25 years behind their belts and in leadership positions, aren’t necessarily best placed to adapt and use these new technologies that are now emerging.”

- Adopt a strategic lens: The ultimate goal is not just to manage threats but to build resilience and agility into the core business strategy. Anticipating regulatory shifts can give first-mover advantage; spotting technological disruption early can inspire innovation. “Businesses that consider how emerging threats relate to fundamental business priorities will not only minimise downside risk, but be better placed to benefit from upside risk,” says Loke.

From threat to advantage

For risk managers themselves, mastering emerging risk is a chance to elevate their influence within the business. Those who can translate uncertainty into insight, and insight into action, will be seen not just as protectors of value but as enablers of growth.

By combining structured frameworks with strategic thinking, UK corporates can move from reactive firefighting to proactive opportunity creation. In doing so, risk managers can help turn uncertainty into a powerful source of competitive advantage.

Managing emerging risks: member perspectives

Fiona Davidge, head of risk and insurance, British Legion: “I ‘reverse think’ emerging risks to make them manageable.”

“Risk management is about dealing with uncertainty – and emerging risks are no different. However, the challenge is that they can be huge in scope with many variables – climate change is one such example. In such cases it is helpful to ‘reverse think’ the problem. Don’t ask, how is climate change going to harm our business? That is too complex. Instead, ask, what are the core aspects of our business that we need to protect to be successful, and could climate change put them at risk? By reframing the question, the problem becomes manageable and focused.”

Susan Young, director, Priory Way Consulting: “Identify board members that will champion your cause.”

“Deciding whether a risk is existing or emerging is not straightforward and binary – some, such as cyber risk and climate change, straddle both. Nonetheless, emerging elements of these risks do demand a different approach because of a lack of data and understanding. My advice for getting buy in at the board level is to do your research, lean on data where it exists and scenarios where it doesn’t. Identify executives that have a strong record on risk management and use them to champion your cause.”

George Ong, partner at Innovative Risk and Insurance Solutions (IRIS) Partnership: “A ‘knee-jerk reaction’ is not an effective approach to emerging risks.”

“It is important to distinguish between short-term volatility and structural emerging risks. How one distinguishes between the two may depend on the industry and size of the organisation. Media reporting could also play a role on what is deemed emerging risks as board members seek assurances from management that the same catastrophe would not happen to them. This could move what should be considered short-term volatility into the emerging risk category. Such a ‘knee-jerk reaction’ is not an effective approach to risk management.”