Mind the gap - time to call time on indemnity?

One of the basic premises of conventional insurance is indemnity settlement. Dr Alan Punter argues that far from permitting insurance, the indemnity principle is in fact a constraint, even a barrier, to product innovation.

The protection gap

The total economic or business cost of a major or catastrophe loss event often significantly exceeds the insurance claims payment. For example, estimates for Superstorm Sandy (2012) are total economic losses of over $70 billion, whereas total insured losses are only around $35 billion.

At the individual corporate level, the impact of a catastrophe event may be felt in many ways – direct and tangible losses in the form of property damage, injury to employees, etc. Other impacts may be less direct and/or less tangible – such as disruptions to the supply chain, and/or deferral of R&D activity or new product launches. Many of the less direct and intangible impacts will not be covered under conventional indemnity insurance policies – and even with insurance, claims may take some months, or even years, to be settled.

Corporate users of contracts with parametric triggers

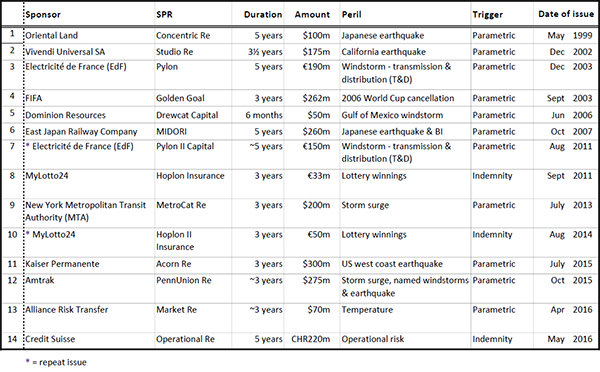

One approach to closing this protection gap is through the use of contracts with parametric triggers, as have been used in catastrophe bonds. The distinguishing features of catastrophe bonds are (a) most often multi-year, (b) fully collateralised, and (c) may have non-indemnity triggers and settlements. Catastrophe bonds are mostly used by re/insurance companies, but a number have been used by corporations (see following table).

Another distinguishing feature of corporate catastrophe bonds is that the perils covered do not have to be mainstream insurable risks – they have covered some 'difficult to insure' perils such as non-damage business interruption, event cancellation, transmission & distribution, storm surge, temperature and operational risk.

Case study

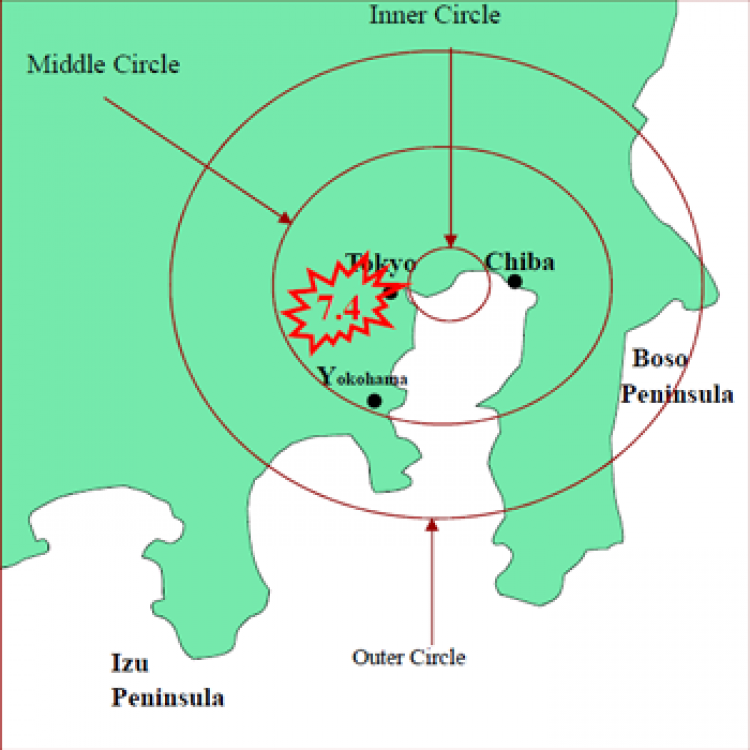

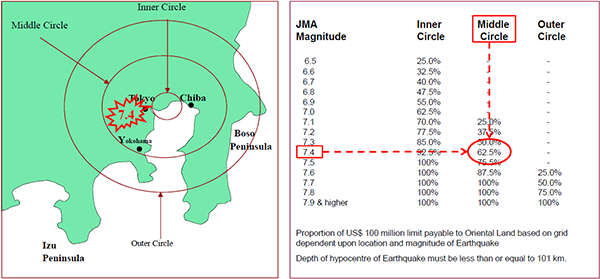

A good example of a multi-year contract, fully collateralised, covering a difficult-to-insure risk with a parametric trigger and settlement, is the $100 million catastrophe bond Concentric Re, arranged by Oriental Land in 1999, as shown in the following exhibit.

For the five-year duration of the policy, if there had been an earthquake anywhere within the three concentric circles, then Concentric Re would have made an immediate cash payment, according the schedule in the table. So, for instance, if there is an earthquake of magnitude 7.4 within the middle circle, then Concentric Re makes a $62.5 million (i.e. 62.5% of the $100 million policy limit) payment to Oriental Land.

Reviewing the distinguishing features:

- The contract is multi-year – here five years.

- The insurance policy is fully collateralised – Concentric Re has $100 million of capital available to pay incurred losses up to the policy limit of $100 million.

- The insurance contract in effect provides non-damage earthquake cover. Any earthquake within the designated circles may not actually cause any direct physical damage to Oriental Land's assets at the centre of the 'dartboard' (actually the Tokyo Disneyland theme park), but Oriental Land still receives payment according the schedule in the exhibit above. Oriental Land's concern was that it had borrowed money to build the theme park and so had debt to service, and its ability to do that could be impaired if there was an earthquake anywhere in the region, because visitor numbers would be adversely impacted, regardless of any actual damage within the park.

- The trigger for the event is parametric, an earthquake of sufficient magnitude within one of the circles, and the determination of the settlement amount is determined solely by the parameters (location and magnitude) of the event itself.

Loss payments under a parametric trigger can usually be made within days. For instance, following Hurricane Matthew (September 2016), the Caribbean Catastrophe Risk Insurance Fund (CCRIF), which offers policies with parametric triggers, made payments totalling $29.2 million to its policyholders within 14 days.

Closing the protection gap - opportunities for corporations

Contracts with parametric triggers offer a possible approach to covering some of those difficult-to-insure risks – going beyond the specified perils and indemnity settlement constraints of conventional insurance – and going some way towards closing the 'protection gap'.

Such contracts need a parametric event trigger (such as earthquake magnitude, wind speed, flood depth, or other weather event) at a particular location, and a formula devised to link the size of any event to the associated settlement amount. The key is being able to model the underlying event risk, and calculate credible probabilities for various size losses, to enable potential investors to assess their risk-return appetite.

The benefit for the corporation securing cover under a catastrophe bond is that a prompt cash recovery of a known amount determined solely by the parametric formula may be considerably preferable to an uncertain (and sometimes partial, after legal fees, etc.) payment of an indemnity amount, likely not received until some years after the event. This is particularly so if the parametric structure can be calibrated to more closely match the full economic or business cost of the event than is achievable under conventional named perils and indemnity insurance coverage.

Dr Alan Punter